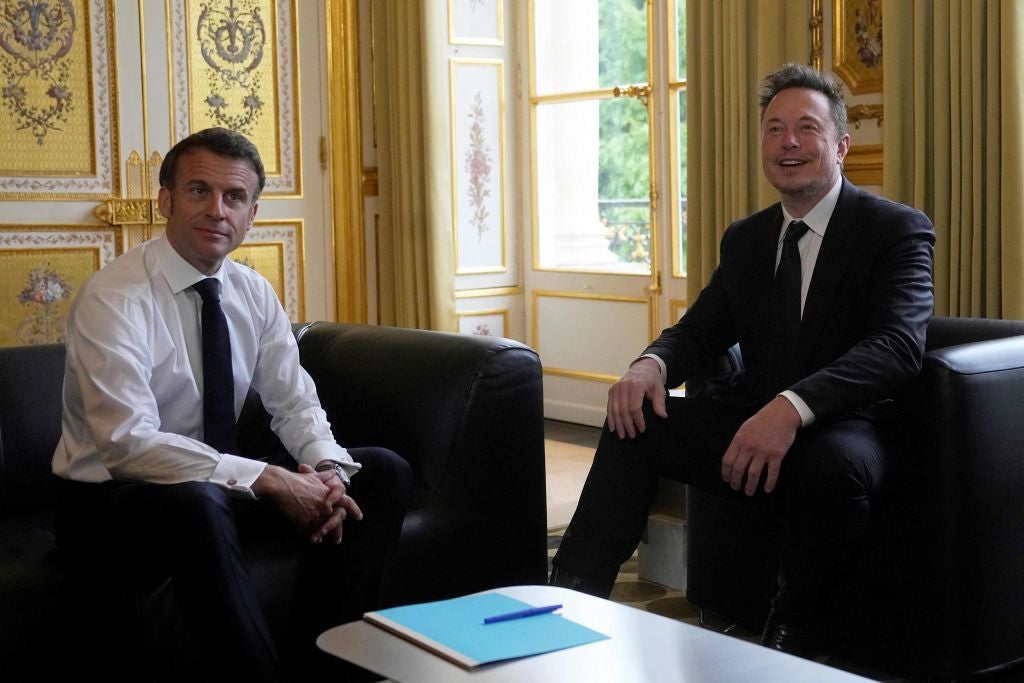

On Monday 15 May, French President Emmanuel Macron welcomed Twitter and Tesla CEO Elon Musk to the Elysée Palace as part of the Choose France summit. Although no formal announcements were made, the South African-born billionaire told assembled reporters that he was impressed with the French Government’s openness to new industry and that he expects Tesla to make “significant investments” in France in the future.

In a tweet, Macron said that the pair had “talked about the attractiveness of France and the significant progress in the electric vehicle and energy sectors. We also talked about digital regulation.”

With more than 200 business leaders in attendance, the sixth edition of the Choose France summit saw a record harvest when it came to foreign direct investment (FDI), raking in some €13bn ($14.02bn). Half of the foreign bosses were European, 20% North American and 15% Asian.

This investment represents a small victory for Macron who, amid spirited domestic debates over his pension reforms, has an all-time low approval rating of just 26%.

France announces 28 FDI projects

The largest project to be announced at Choose France was a Dunkirk-based gigafactory that will manufacture next-generation batteries by Taiwanese company ProLogium. The project, worth €5.2bn, will create 3,000 jobs. In the same city, a joint venture between Chinese company XTC and French company Orano will construct a battery component and recycling factory for a total investment of €1.5bn.

Holosolis, a subsidiary of the European conglomerate InnoEnergy, is also set to build a photovoltaic panel manufacturing facility in Sarreguemines, with a total investment value of €710m.

Swedish furniture group Ikea also announced €906m of investment in France by 2026, which will involve the creation of a logistics centre near Toulouse.

Within the pharmaceutical sector, US company Pfizer is investing a further €500m in France, which will serve to enhance its capabilities in clinical oncology trials and traditional research. Meanwhile, the British biopharma company GSK has announced an investment of €240m across three production sites in Evreux, Mayenne and Saint-Amande-les-Eaux.

This comes as the UK was found to be the third-biggest investor in France (behind the US and Germany) in 2022, thanks in part to notable investments from Birmingham-based Euro Packaging Group and Scotland-based IMET Alloys.

France hits foreign investment high

Despite the turbulent international conditions, France recorded its highest-ever number of FDI projects in 2022: 1,725, which are expected to create 58,810 permanent full-time jobs over the next three years. This represents a 7% increase in projects on 2021 figures, as well as 31% growth in jobs created or maintained from FDI compared with the previous year.

Manufacturing accounted for the largest share of foreign investment in France in 2022 with 457 projects, while foreign investment in business services experienced the highest level of growth (at more than 26%).

In a speech about reindustrialisation made on 11 May, Macron spoke of his willingness to “lower the cost of work and capital” in order to attract foreign investment. He also pledged to invest €700m in training the country for the jobs of the future, opening up 15,000 more apprenticeships.

Macron’s business-friendly reforms, announced at the beginning of his first five-year term, are being credited with laying the groundwork for the country’s surge in investment. Shortly after assuming office in 2017, Macron announced a progressive decrease in corporate income tax from 33.3% in 2017 to 25% by 2022.