Each week, Investment Monitor’s editors select a deal that illustrates the themes driving change in our sector. The deal may not always be the largest in value or the highest profile. We select it because of what it tells us about where the leading companies are focusing their efforts and why, or which locations are attracting investment. We pick apart the deal itself and the industry theme behind it. This thematic deal coverage is driven by our underlying disruptor data, which tracks all major deals, patents, company filings, hiring patterns and social media buzz across our sectors.

The deal

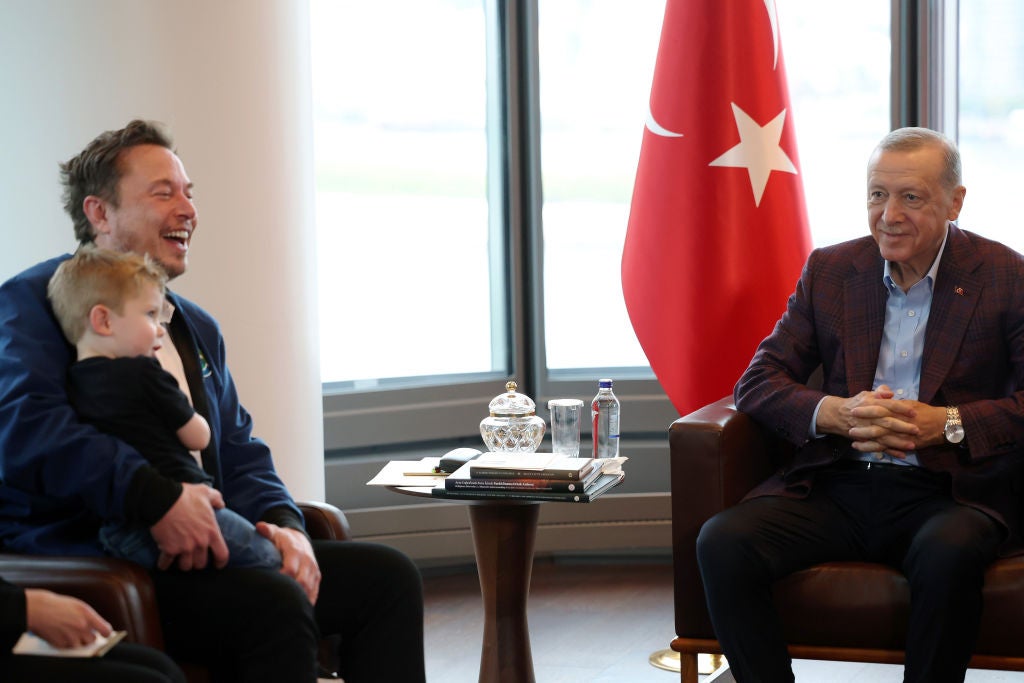

There is no deal. Yet. However, Turkey’s recently re-elected president, Recep Tayyip Erdoğan, met with Tesla CEO Elon Musk in New York and asked that the electric vehicle (EV) manufacturer build a gigafactory in his country. Musk responded by highlighting that Turkish suppliers are already working with Tesla. He added, tantalisingly, that Turkey is a key candidate for the company’s next factory.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Why it matters

There is barely a prime minister, president, king, queen, dictator, supreme leader, chancellor or chairman in the world who wouldn’t welcome a Tesla factory opening within their country. The capital investment, the jobs created, the green credentials, the high profile… an investment from Tesla carries that bit more cachet than an equivalent project from almost any other company would (outside, perhaps, of the semiconductor industry). In that respect, Turkey’s play for this kind of investment is not particularly noteworthy. However…

Turkey’s presidential elections earlier in 2023 were a fraught affair for Erdoğan, whose popularity had been damaged by what many saw as an insufficient response to the country’s devastating earthquakes earlier in the year. Kemal Kılıçdaroğlu was predicted by some to finish first in the vote, and although Erdoğan ended up winning by a margin of 52% to 48%, the close-run nature of the contest seems to have caused the re-elected president to rethink some of his more unorthodox and abrasive stances.

A new President Erdoğan seems to have emerged in the aftermath of the election, more Western-friendly, more open to foreign investment, more likely to embrace more orthodox economic policy. President Erdoğan 2.0 immediately appointed a new finance minister and central bank governor. Foreign policy was altered, which brought about the endorsement of Sweden’s membership of Nato. In exchange, Erdoğan has called on European leaders to restart talks regarding Turkey’s prospective EU membership, a long-held ambition of Ankara. Efforts have also been made to build bridges with Saudi Arabia and the United Arab Emirates.

The early signs are promising for Turkey. In the earlier years of Erdoğan’s rule, Turkey had been a foreign direct investment (FDI) star, but that reputation had dimmed in recent years. However, in August, Turkey announced four big FDI deals – from BASF, Seawind Catamarans, WEG and Böllhoff – in a promising early sign that the country is back on track when it comes to wooing foreign investors, particularly from Western countries. Will this lead to the biggest prize of all, however, and a Tesla flag flying over a gigafactory on the outskirts of Istanbul or Bursa?

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataInvestment Monitor chief economist Glenn Barklie says: “Turkey will face stiff competition. Many European countries believe they are at the forefront of EV and battery technologies and have the domestic demand and market access to the wider European consumer base to offer an attractive proposition. Access to talent (particularly engineers), costs (labour, utility and property) and incentives will be key drivers for Tesla’s final decision.”

As for why Erdoğan has made such a public play for Tesla, Barklie adds some context: “In 2023 alone, battery manufacturing FDI projects are averaging more than $1bn in project value, while EV operations are valued around $850m, on average, per project. Both subsectors are also creating more than 1,000 jobs per project, on average.”

Outside of the US, Tesla has gigafactories in Canada, China, Germany and the Netherlands, with another planned for Mexico. That leaves a lot of automotive behemoths competing for the company’s next overseas project, with India considered a front-runner. A friendly chat with Musk doesn’t seem to have done Erdoğan any harm, and the Tesla CEO has promised a decision on the company’s next big investment by the end of 2023. The Turkish president has momentum behind him, but a major investment from such a high-profile company would cement what has been a big turnaround in fortune for Erdoğan since his stock plummeted in the aftermath of Turkey’s tragic earthquakes in February.

The detail

EV manufacturer Tesla will announce the location of its next major overseas investment by the end of 2023. India and Turkey have now both made major plays for the project, but the company is known for its meticulous research, and it will take more than public pleas to influence Musk et al when choosing their destination.