While 2023 was a year marked by global energy security concerns that saw record-level government subsidies for fossil fuels, 2024 is set to see an uptick in greenfield FDI for renewables projects, as well as new projects coming online that will grow global green energy capacity.

Despite geopolitical concerns, pandemic-related supply chain issues, construction hold-ups and record-high commodity prices for raw materials, renewable energy continued to gain momentum in 2021 and 2022, according to the International Renewable Energy Agency (IRENA).

Globally, green energy is taking up a bigger share in covering demand. In 2022, Australia recorded its first instance of renewables providing more than two-thirds of power to the nation’s primary grid.

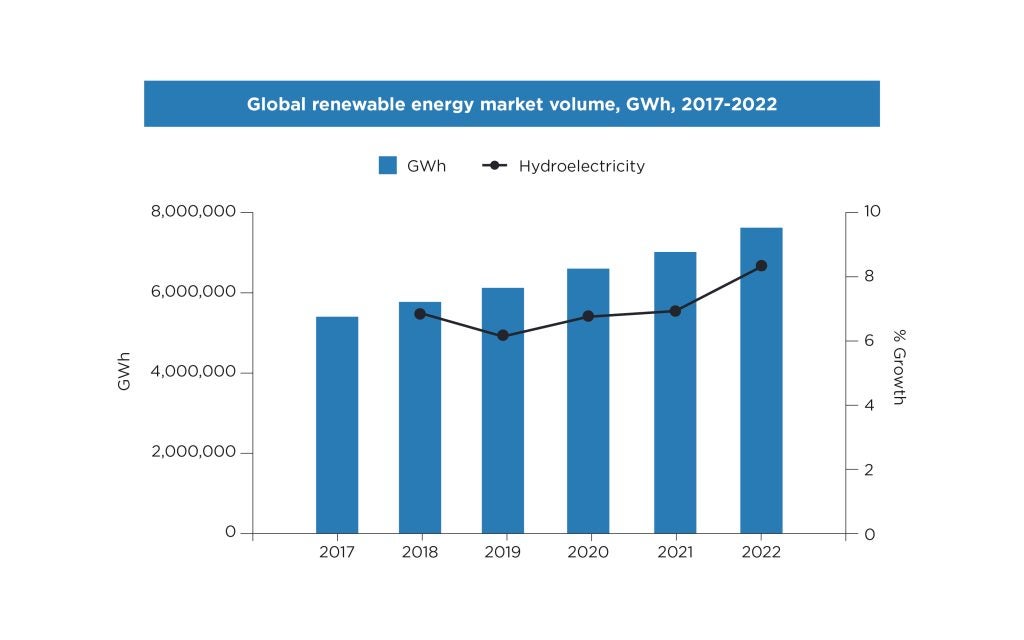

While cumulative data for 2023 is still being finalised, the last quarter of 2023 marked a major energy milestone for Europe, with more electricity generated from wind than coal, according to Reuters. By 2027, GlobalData estimates the renewable energy market will be worth $644trn – an increase of 25% since 2022. By that same year, renewable energy capacity is forecast to increase by 42.4% to roughly 10.9 gigawatt-hours.

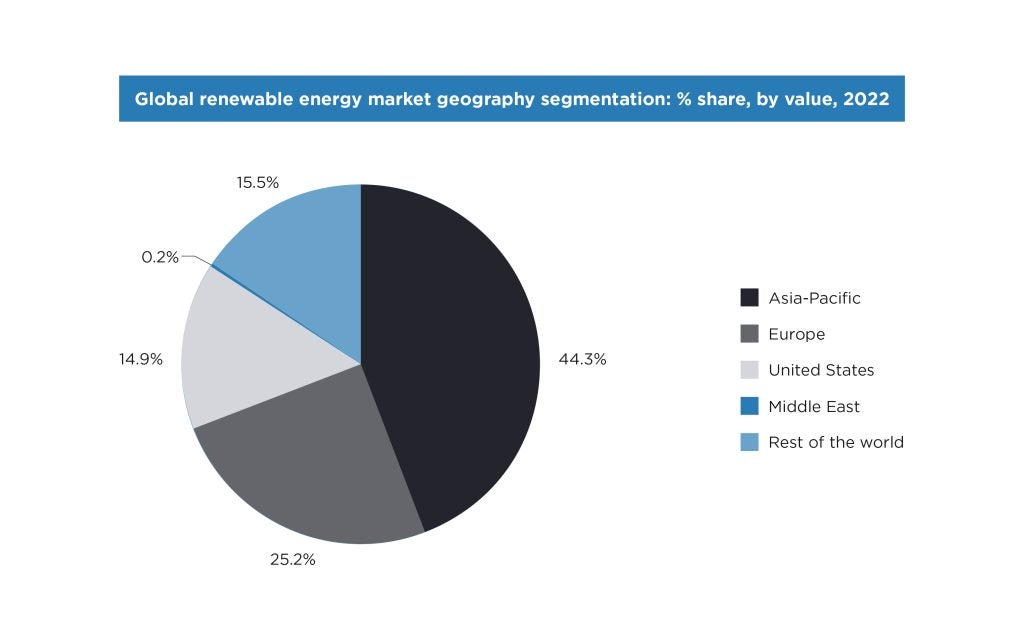

The Asia-Pacific region is one of the fastest growing and currently holds the largest market share, representing 44.3% of the global market. In terms of the number of FDI projects, western Europe leads the way. While Oceania makes up a much smaller global share, it is the only region that has seen consistent five-year growth with announced projects doubling from 2019 to 2021; 41 projects were announced in 2021 and a further 49 projects in 2023.

Getting the energy transition on track

However, even with significant progress made, IRENA’s World Energy Transitions Outlook 2023 report begins by warning that “The energy transition is off-track.”

Temperatures have already risen by at least 1.1°C, and according to analysis from the UN Environment Programme, the world is set for global warming of up to 2.9°C. At the 2015 Paris Agreement meeting, delegates agreed to limit the global temperature increase to 1.5°C, but even if countries stick to the pledges made at that conference temperatures will rise beyond the necessary targets.

Getting back on track will require massive global investment and concerted efforts between governments, the private sector and universities, creating a pipeline of talent to fill the required jobs.

Green energy storage, capacity and generation capabilities will all need to grow to stay on the 1.5°C pathway. According to IRENA, around 1,000GW of additional renewable power is needed annually to limit global warming in line with the Paris Agreement. In 2022, just 300GW of renewables were added globally.

“Both the volume and share of renewables need to grow substantially, which is both technically feasible and economically viable,” the report finds.

To achieve this, a cumulative $150trn is required by 2050 – an average of $5trn annually invested across all transition technologies. In 2022, total investment reached $1.3trn. For renewable energy, investment hit $500bn.

“In FDI terms, renewable energy is a key industry. Governments have commitments to reduce carbon emissions and foreign companies are primed to support these targets, especially in developing economies,” says Glenn Barklie, Investment Monitor’s chief economist.

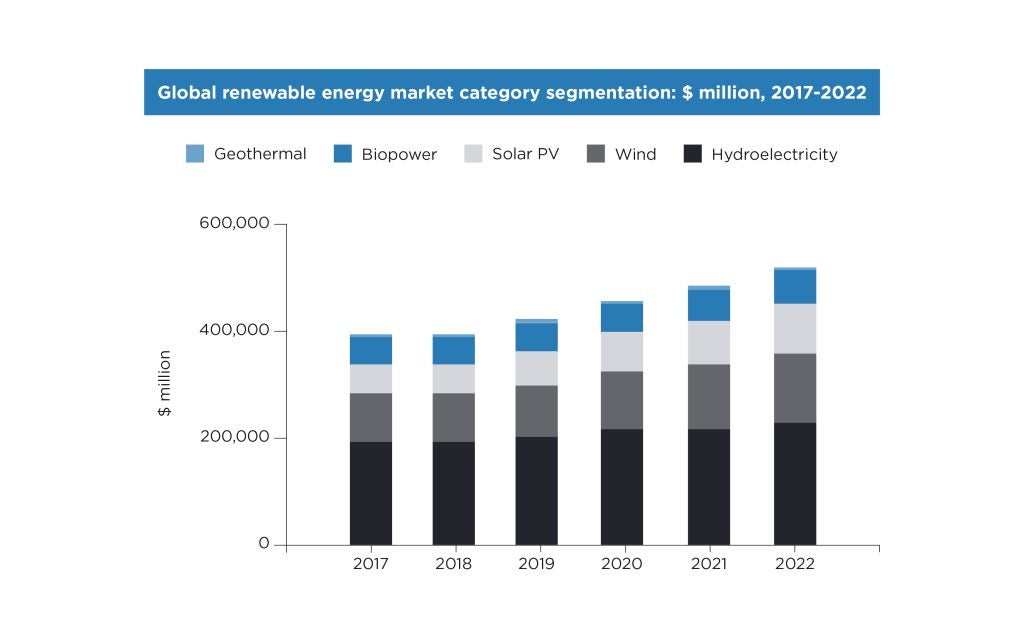

Most investment towards renewables went to solar photovoltaic and wind power in 2022, which attracted 95% of investment. However, hydroelectricity represents the biggest renewable energy market segment, according to GlobalData figures.

Three-quarters of global investment for renewables between 2013 and 2020 came from the private sector and therefore flows towards technologies and countries with low real or perceived risk. Where 83% of wind power investment came from the private sector, geothermal and hydropower attracted 32% and 3%, respectively, with the bulk of finance coming from governments.

“Greater volumes of funding need to flow to other energy transition technologies such as biofuels, hydropower and geothermal energy, as well as to sectors beyond power that have lower shares of renewables in total final energy consumption (e.g. heating and transport),” IRENA analysts report.

S&P Global's Commodity Insights Inflections Reference Case forecasts expect $700bn per year of renewable energy investment through 2050, which means the annual funding gap could be as large as $700bn.

Governments have made various pledges to fund the energy transition. For example, China, the US, the EU, as well as Australia have all made sizeable financial commitments to climate change. In 2022, Australia invested $4.3bn, up from 17% in 2021, according to a report from the country’s Clean Energy Council. In addition, the October 2022–23 budget announced A$25bn ($17.3bn) of government funding for renewable energy spending as part of its move towards net-zero emissions by 2050.

Investing in renewable energy

Since 2019, investment attracted to renewable energy projects as a share of total greenfield FDI has increased through to 2023, doubling from 2.6% to 5.1%. That is representative of a 16.21% growth rate – and 2024 is likely to see more investment in the renewables space.

Most regions have seen a steady rise in investment in renewables projects over the past four years. In 2024, that is likely to continue.

“We expect renewable energy to continue to account for a larger proportion of total greenfield FDI projects in 2024,” says Barklie. “We expect to see the continued growth of the hydrogen and energy storage subsectors as well as a strong bounce back in wind projects as macroeconomic conditions improve. Solar will remain the key renewable energy subsector.”

As foreign, private and government spending continue to flood into the renewable market, new jobs and new skills will be needed to fuel the energy transition.

Work by IRENA and the International Labour Organization (ILO) has shown that the renewable energy sector employed some 12.7 million people worldwide in 2022, growing from about 7.3 million in 2012.

IRENA’s energy transition modelling has shown that tens of millions of additional jobs will likely be created in the coming decades as investments grow and installed capacities expand.

“The energy transition will require a broad mix of skills, and filling these jobs will require coordinated action in education and skills building. Governments will have a critical role to play in ensuring universities and the private sector are aligned,” IRENA’s report finds.

McKinsey forecasts that by 2030, to build solar and wind plants, 1.1 million workers will be needed, alongside an additional 1.7 million workers to operate and maintain new plants. However, these figures don’t include jobs in nuclear or hydrogen energy, green mobility – such as electric vehicle and battery manufacturing – or hydropower.

The EU, the US, Africa and Australia have all identified their own talent shortages, and are now working quickly to fill the skills gap. For example, in Australia, where the national target is a reduction in greenhouse gas emissions of 43% from 2005 levels by 2030, heavy government investment has created tens of thousands of jobs as the country races ahead to achieve this goal. The A$25bn renewable energy fund announced in the 2022–23 state budget includes funding for projects that open opportunities for investors in clean energy and renewables.

Worldwide, transitioning to green energy will take international cooperation, investment and a focus to train and equip workers with the skills needed. In Australia, these factors are aligning to create a clean energy ecosystem where funding for renewable energy projects is flowing to entrepreneurs and large businesses. Universities, specifically those in Melbourne, are dedicated to creating a pipeline of talent to fill the thousands of new jobs that are expected. For example, researchers at the University of Melbourne teamed up with Meridian Energy Australia to develop a real-time wind forecasting system to enable the renewable energy transition. The project was backed by a A$2.18m grant from the Australian Renewable Energy Agency.

Underpinning these efforts is a supportive national and state-level government that has set targets, passed the right legislation and put appropriate incentives in place to fuel the transition.

To learn more about renewable energy in Australia, download the free whitepaper.