The new UN Trade and Development (UNCTAD) report Global economic fracturing and shifting investment patterns offers a comprehensive look into the future of global capital flows in a time of mounting global economic fracturing, writes Bruno Casella, senior economist in the Chief Intellectual Property Unit at UNCTAD.

Firstly, the report highlights a major change: foreign investment growth isn’t keeping up with the usual economic indicators like GDP and trade. Despite a growing global economy, investment growth has been stagnating for over a decade. In a nutshell: the global markets have continued to expand, but the global factory has stopped growing.

Multinational enterprises, the primary drivers of international production, are increasingly cautious about expanding their operations globally, especially in tangible assets. Accelerated automation, political shifts towards interventionism and protectionism, and the imperative of sustainability, on one hand, and heightened investors’ risk perception due to the pandemic and geopolitical tensions, on the other, are complicating the landscape of international investment.

Investment in services

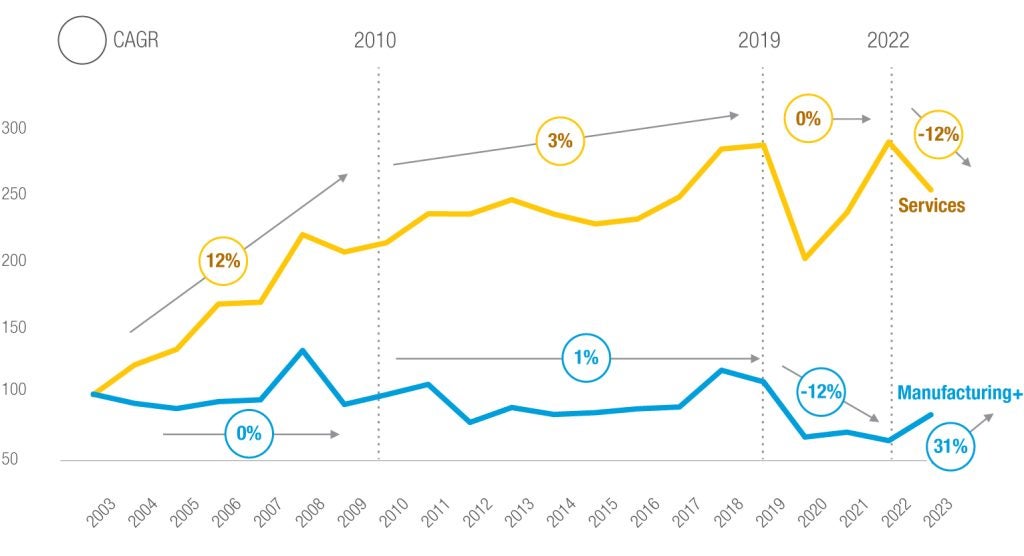

Another major shift is the rise of the services sector in attracting investment, taking over from manufacturing. The share of cross-border greenfield projects in the services sector rose from about 65% two decades ago to over 80%. And services-related investment within manufacturing industries nearly doubled to about 70%.

Meanwhile, FDI in manufacturing has seen a significant downturn, with an average annual decline of over 10% in the three years following the outbreak of the pandemic (figure 1). This affects smaller economies that rely on manufacturing, putting them at a disadvantage and making it harder for them to join global markets and adopt new technologies.

Investment in China

Another big change is China’s shrinking role as a top destination for investment. Companies aren’t as keen to invest there anymore. Despite waning interest from multinational corporations in initiating new investment projects in China, the country continues to maintain a dominant position in global manufacturing and trade.

Far from downsizing, ‘Global Factory China’ is thus changing its operational model from globally integrated to more domestically focused production networks while still maintaining its leadership in global trade.

Economic fracturing

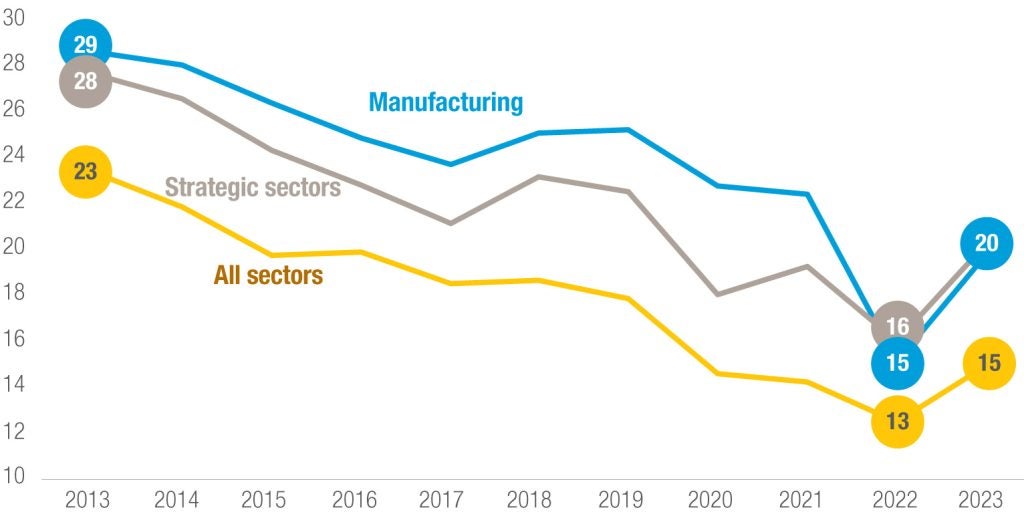

Economic fracturing is a major point of the report. Digging deeper into the concept, economic fracturing is not precisely defined. Broadly, it entails the rupture of historically established investment relationships between countries. However, it’s not simply a gradual divergence of economic and business interests, which would be business as usual. Instead, it’s a sudden disruption driven by geopolitical forces, with little bearing on economic fundamentals. This aspect adds a significant component of uncertainty to normal economic and business dynamics.

The report shows that in the last decade, comprising the escalation of trade tensions, the pandemic, and recent geopolitical crises, investment relationships have become more unstable and volatile. Meanwhile, investment between geopolitically unaligned countries is in decline, showing that geopolitics plays an increasingly important role in investment location decisions (figure 2).

Sustainability and development

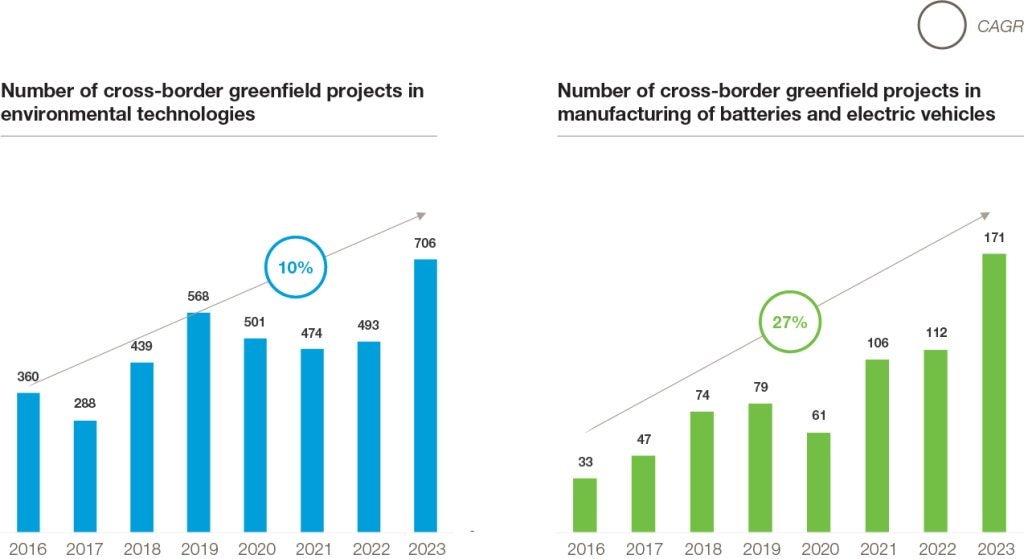

The last part of the report, focusing on the grand challenges of sustainability and development, presents a dual narrative. Sustainable investment is rapidly expanding in sectors such as environmental technologies and batteries and EVs. Since 2010, while manufacturing investment stagnated across all industries, the number of cross-border greenfield projects in these sectors has grown at rates of 10% and 27% per year, respectively (figure 3).

However, these emerging opportunities only partially offset the lack of FDI growth in other industrial sectors. Smaller and less developed countries are increasingly missing out on investment opportunities and becoming marginalised. Larger developing economies are capitalizing on the services sector boom, leaving smaller nations behind. This creates an imbalance that urgently needs fixing.

So, what’s the solution? The report calls for action to bridge these investment gaps. It suggests rethinking development strategies based on promoting investment in manufacturing, export-led growth, encouraging investment in sustainable goals, and strengthening global cooperation to keep investment flowing amid a very challenging geopolitical context.