Global IPO markets are set for a gradual recovery following a rebound in US and European activity from Q3 2023. A strong pipeline of offerings had begun to build, driven by an anticipated shift from maintaining policy rates to potential rate cuts in 2024, however, the Federal Reserve’s unchanged rates and a dovish tone in December have heightened expectations for a market recovery.

Prospective issuers have been gauging investor appetite for new offerings through the post-IPO performances of high-profile companies launched after the third quarter of 2023. Meanwhile, investor demand will be directed towards IPOs of sector-leading companies perceived as reasonably priced, and offer a balance between profitability and growth.

Privatisation powers IPO activity in MENA

Similarly, a rebound in the MENA IPO market will be supported by a strong pipeline which includes several deals that were postponed to the first half of 2024 on expectations of easing market conditions. The privatisation of state-related entities will continue to drive IPO activity in the near term with the private sector driving the next phase of growth, starting with family-owned companies experiencing a generational shift in leadership and those aiming to drive business growth, ensure continuity, and raise governance standards. Following several listings of MENA-based FinTech and tech-enabled start-ups that were more than 30 times oversubscribed, a surge in the number of unicorns could lead to more start-ups going public, offering VC investors a viable exit option, while building a strong IPO pipeline.

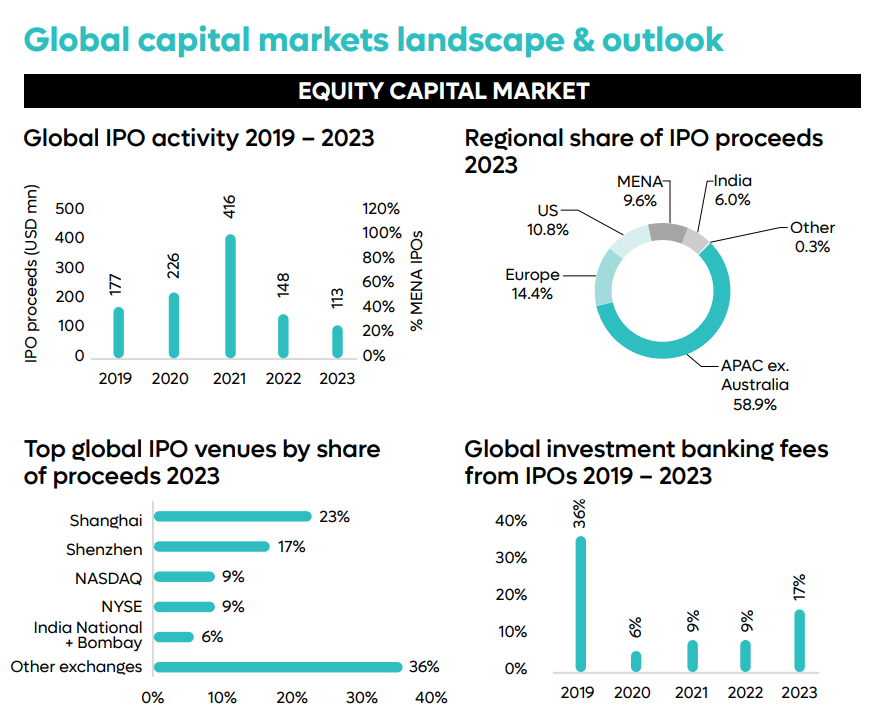

Global IPOs raised just $112.5bn in 2023 after nearly two years of sluggish activity concentrated in larger, more mature equity markets such as the US, Europe, and Hong Kong. A slowdown in IPO activity began in 2022 with IPO proceeds down 64 per cent year-on year to $148bn, as prospective issuers opted to defer their IPOs due to a reset in valuations that followed a series of interest rate hikes.

By the end of 2023, IPOs accounted for only five per cent of global investment banks’ fee revenues, a significant decrease from 13 percent in 2021. The decline was largely due to multiple interest rate hikes, which suppressed market activity. In 2022, IPO fee revenues fell by 70%. The downward trend persisted into 2023 with an additional 18% drop, as major IPOs were delayed until more favourable market conditions emerged.

Global debt issuance set to rise

Global debt issuance is projected to grow by a modest 2.3% in 2024, with interest rates likely to remain at multi-year highs. This growth is mirrored in MENA debt markets, driven by sovereign issuances intended to finance budget deficits and major development projects, and to refinance maturing debt. However, issuers with substantial refinancing requirements in 2024 and 2025 will face high refinancing costs due to ‘higher-for-longer’ rates.

In 2023, overall global debt issuance reached $8.9 trillion, a 6% increase from 2022. This followed a 19% decrease in 2022 from 2021 as supranational and sovereign issuers reduced funding for Covid measures. MENA debt issuance nearly doubled in 2023, although it was still lower than the total recorded in each of the preceding five years. Sukuk issuance remained resilient, setting a record of $214.9 billion in 2023, a 9.9% increase from 2022, supported by continued strong demand for these investments.

International private wealth drives Dubai’s resilience

MENA capital markets have seen significant enhancements over the past decade focused on infrastructure development, private sector participation, and foreign investment attraction. Privatisation initiatives in Dubai and Saudi Arabia have deepened and broadened capital markets while creating additional sovereign liquidity for economic projects. The United Arab Emirates (UAE)’s DFM IPO Accelerator Programme and Abu Dhabi IPO Fund were launched to increase IPOs from the private sector. Other enhancements include the establishment of parallel markets for SMEs, market maker funds and the GCC Exchanges Committee’s issuance of unified ESG Disclosure Metrics in line with global best practices.

The UAE has increasingly attracted international private wealth, with 120 of the world’s wealthiest families and individuals based in Dubai International Finance Centre (DIFC), with a total net value of $1.208 trillion. This influx has led to an increasing number of international asset and wealth managers expanding their presence in Dubai as they look to tap growing private wealth and fund inflows from institutional investors across the Middle East, Africa and South Asia (MEASA). DIFC is also becoming a global centre for alternative investments and hedge funds, with more than 65 already registered.

Dubai-based banks have actively participated in MENA capital markets, leveraging their longstanding regional presence and expertise to become the preferred choice for UAE and MENA IPOs. Dubai and DIFC serve as gateways to MEASA growth markets, which has led to the relocation of investment banking and ECM specialists from developed markets to Dubai, spurring hiring activity in the region.

Dubai offers two listing platforms for IPOs: Dubai Financial Market (DFM) and Nasdaq Dubai. DFM, the primary IPO venue, aims to double its market capitalisation to $20 billion following a recovery in IPO activity in 2022. Nasdaq Dubai, on the other hand, is one of the world’s largest centres for sukuk, with $74 billion currently listed.

DIFC is continuing to support wealth management and investment in one of MENA’s largest financial hub. To learn more, click the banner on this page.