This comment is delivered by GlobalData Economists Ollie Brown and Nicolas Orestis Psaroudis

The combination of COVID-19, US-China trade warfare, high (but depreciating) global inflation, and exacerbating conflict in Eastern Europe and the Middle East, has instigated dramatic revisions in global supply chains in favour of reshoring and nearshoring. Arguments about whether a definitive deglobalization trend is underway are speculative. Albeit two realities are evident for MNCs: First, minimizing supply chains – through reshoring, nearshoring, or a combination of both – mitigates financial risk in an increasingly hostile international economic climate, rife with trade embargoes. Second, minimizing supply chains decreases potential exposure to geopolitical conflict. Aside from this, political actors are facing domestic pressure to safeguard jobs and prioritize economic sovereignty. Therefore, there exists a clear impetus driving reshoring/nearshoring, evident in Latin American and Southeast Asian economies.

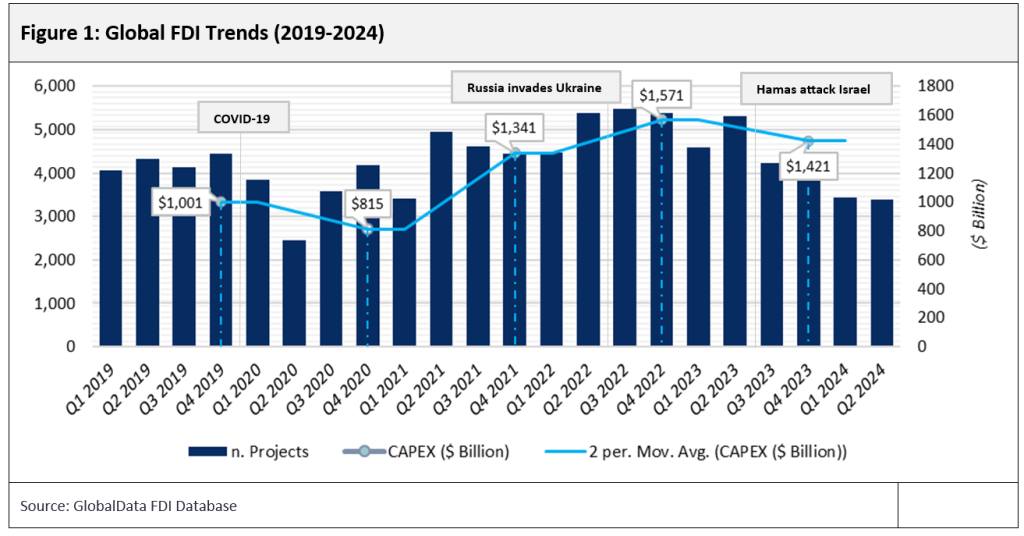

While Global FDI Statistics – drawn from GlobalData’s FDI Database – are not precisely proportional to reshoring and nearshoring, they are indicative of wider trends in global trade, depicted in Figure.1. Consistently, macroeconomic shocks highlighted in Q1 2020, Q3 2022, and Q3 2023, have instigated decreases in total capital expenditure (CAPEX) invested and sum quarterly number of FDI projects launched (n. Projects), reflective of widespread efforts to reshore/nearshore.

Reshoring: The Benefits/Challenges

The key benefits derived from reshoring/nearshoring include lessened risk of disruptions, reduced delivery times, greater flexibility, improved quality control, and greater environmental sustainability. These positive effects enhance competitiveness and customer experience. It also allows for production levels to be adjusted swiftly according to fluctuating demand, streamlining operations and reduction of waste. Manufacturing nearby also facilitates quality control, enabling quick resolution of issues. Additionally, shorter transportation distances reduce logistics costs and CO2 emissions and thus create a more sustainable supply chain.

However, reshoring/nearshoring does not come without its challenges, which include rising labour costs, resource limitations, and an increase in regulatory complexities. Countries near major consumer markets tend to have higher labour costs than traditional manufacturing hubs like India or China, which can increase the cost of production for firms and lower project viability. Additionally, some regions may lack the infrastructure and resources needed for large-scale manufacturing, potentially causing issues in meeting production demands and maintaining quality. Adapting to local regulations in new manufacturing locations can be both complex and costly, requiring companies to navigate diverse legal and compliance frameworks.

Not to mention, if high wages or costs of raw materials offset the advantages of reshoring/nearshoring, companies may not be able to move operations on a large scale while remaining competitive. Therefore, companies will likely seek to mitigate supply chain risk by primarily moving within emerging markets to take advantage of lower wages and low-cost manufacturing, while simultaneously developing greater supply chain flexibility.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSoutheast Asia

Following the pandemic, nations like Vietnam, Malaysia and Indonesia have become outbound locations for reshoring and nearshoring in Southeast Asia, emerging as prominent alternatives to China. The region’s appeal is driven by its favorable geographical location, competitive labour costs, and supportive foreign investment policies.

For example, Vietnam is geographically close to large consumer markets like Japan, South Korea, and China, reducing transportation time and costs compared to more distant regions. Furthermore, in Vietnam, wages are lower than in many other countries in the area, including China, which helps reduce production costs and enhance competitiveness. Finally, the government has also implemented several policies which support foreign investment and create a favourable environment for international companies to invest and establish production facilities in Vietnam. These policies include land lease incentives, tax exemptions and infrastructure development support.

According to GlobalData’s FDI database, Japan-based company, Shizen Energy, is investing $16.9 billion to develop a 6000MW Can Gio Offshore Wind Farm in Vietnam’s Ho Chi Minh City. Additionally, US tech giant, Apple, has moved a large portion of their production of iPads and watches out of China and into Vietnam. Major footwear brands, Nike and Adidas, have made similar moves prompted by Vietnam’s political stability and low labour costs. In the case of Southeast Asia, favorable trade agreements, government incentives, and the region’s proximity to major markets like China and India have further fueled the trend of reshoring/nearshoring.

Latin America

Parallel to tightened Southeast Asia trade, and inversely to evident global divisions, the US is confiding in Latin American resources and manufacturing, despite immigration concerns from Latin America dominating US election headlines. Nevertheless, Latin America presents a substantive labour force with competitive labour costs and a geographically advantageous position, insular to maritime trade disputes, and cultural compatibility.

According to GlobalData’s FDI Database, inward FDI to South America has increased YoY in 2021 ($187.841 billion), 2022 ($290.055 billion), and 2023 ($293.471 billion); a 1.2% increase from 2022 to 2023 purports that South American FDI is stalling. Though, considering global FDI decreased by approximately 10% over the same period, comparative investment remains promising. To elaborate, MNCs – particularly in the US – are looking to South America as an FDI alternative:

- In March 2023, US-based Tesla announced plans to build a gigafactory in Mexico, estimated to cost $10 billion in totality.

- In April 2023, US-based Exxon Mobil approved $12.7 billion for a fifth oil project off the coast of Guyana.

- In February 2024, US-based General Motors (GM) announced plans to invest $1.4 billion in Brazil by 2028.

- In March 2024, US-led Stellantis – who specialize in automotive technology – announced plans to invest $6.2 billion across Latin America from 2025 to 2030.

- In June 2024, US-based Chevron began talks with PDVSA – the Venezuelan state-owned oil and natural gas company – to increase off-shore crude oil production at an estimated cost of $10.7 billion between 2033 and 2047.

- In September 2024, US-based Amazon Web Services (AWS) announced plans to invest $1.8 billion for data centers in Brazil through to 2034.

Therefore, Latin America poses an attractive and growing FDI climate, driven by US nearshoring. However, growth is caveated by politico-economic headwinds. For example, in Argentina, inflation remains above 200% and in Venezuela, controversy surrounding the July 2024 elections continues to spark government repression and instability. Elsewhere, in Mexico, the cartel influence remains ubiquitous and in Brazil, a weak currency and rising inflation caused the central bank to hike rates on September 18th and has hinted at future rate hikes to come. Furthermore, the election in the US will unequivocally affect North and South American relations, adding to investment uncertainty. Therefore, the onus for future FDI to Latin America hinges on the degree to which these headwinds can be addressed, to collectively offer an attractive investment environment to MNCs.

Outlook

In the coming years, reshoring and nearshoring are expected to continue growing strongly, particularly in regions with policy and geographical advantages, such as Southeast Asia and Latin America. While global trade is fracturing at either pole of the US-China divide, regional economic cooperation is tightening, exhibited by multibillion-dollar investments by MNCs. These are not just temporary trends, but long-term strategies that can help companies mitigate risks from global supply chain disruptions and boost competitiveness.