This comment is delivered by GlobalData Economist Ollie Brown.

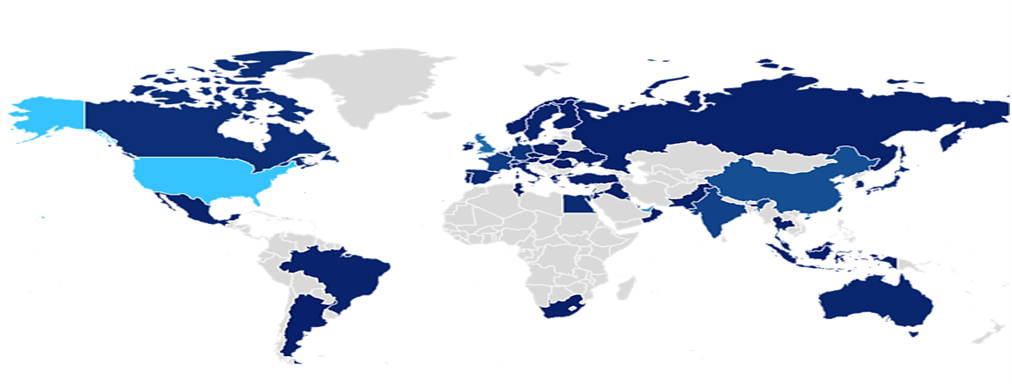

Strong economic foundations and extensive international relations contribute to growing FDI in Saudi Arabia’s tourism, construction, electronics, and financial service sectors, among others. Correspondingly, GlobalData’s FDI database records 735 announced and 572 opened FDI projects in Saudi Arabia, between Q1 2019 and Q3 2024. That said, as the Israel-Gaza conflict threatens to further spread throughout the region, threats to attracting and retaining new projects heighten. As a result, the onus to protect incoming Saudi Arabian FDI depends on maintaining strong diplomatic relations.

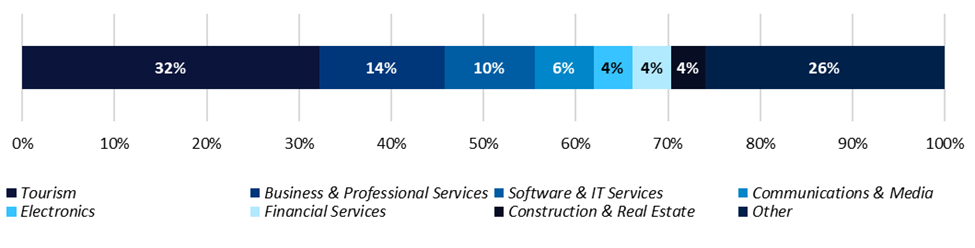

Tourism dominates in the FDI sector, as it accounts for 32% of incoming projects, driven by the Ministry of Tourism’s pursuit to reach 150 million tourists by 2030. Specifically, InterContinental Hotels Group (UK), Hilton Worldwide Holdings (US), Jin Jiang International Holdings (China), Marriott International (US), and Accor (France), each have 20+ active projects across Saudi Arabia. It is evident that Saudi’s well-documented diversification away from petrochemicals is under fruition, but the prosperity of noted FDI ventures hinge on sustaining a healthy and inclusive investment climate.

- Saudi Arabia’s net FDI rose 5.6% in Q1 2024 alone.

- Corporate Income Tax (CIT) sits at 20% and inflation steady at 1.5%, as of July 2024.

- SAR.USD= 0.27, SAR.GBR= 0.20, SAR.CNY= 1.89, as of September 2024.

As conflict proliferates across the Middle East, and the US mounts pressure on Saudi Arabia to mediate relations between Israel, Palestine, Iran and Lebanon, this ability to prioritize economic objectives may wane. For instance, a step towards Israel could deter Russian, Chinese, and Turkish investment. Similarly, public sympathy with Iran – whom Saudi Arabia only recently revitalized diplomatic relations with – could deter investment from westward nations. To date, Saudi Arabia has navigated this fragile dynamic remarkedly well. However, the future for Saudi Arabian FDI hinges on whether diplomats can continue leveraging strong international politico-economic relations, attracting business, whilst simultaneously distancing themselves from geopolitical tensions.