A comparison between India and China often emerges as a focal point in discussions and industry conferences. A recurring question is whether India’s automotive market will encounter a take-off point akin to China’s.

In my assessment, this scenario is improbable.

There are obviously major disparities between these two Asian behemoths, ranging from their forms of government to the development, composition, and growth trajectories of their economies.

China’s leadership style has arguably facilitated more decisive and unified economic action, resulting in efficient policy formulation and implementation. On the other hand, India’s democratic but fragmented government leadership frequently results in protracted discussions, debates, and inconsistent policies.

An industry observer has termed this scenario a ‘policy soup.’ It appears that chefs from various government ministries are adding their own ingredients, ultimately creating a dish that few find palatable.

China’s automotive market experienced a takeoff after joining the World Trade Organisation in 2001. The government made massive investments in infrastructure and mandated global automakers to form joint ventures with Chinese OEMs, promoting technology transfer and domestic capabilities.

Moreover, the Chinese government’s substantial fiscal stimulus in response to the 2008/09 global financial crisis directly spurred new vehicle sales. This intervention showcased the government’s capacity to marshal resources supporting pivotal industries.

China’s export-oriented growth model backed all of this. Consequently, this generated significant trade and current account surpluses, providing the financial means for capital goods imports and substantial economic investments.

In contrast, India has grappled with chronic trade and current account deficits, along with a government budget deficit that has historically been greater than that of China as a percentage of GDP.

“India’s structural weakness has thus constrained investment growth,” points out Meg Sunako, Senior Analyst, Economics and Topline Forecasts at GlobalData.

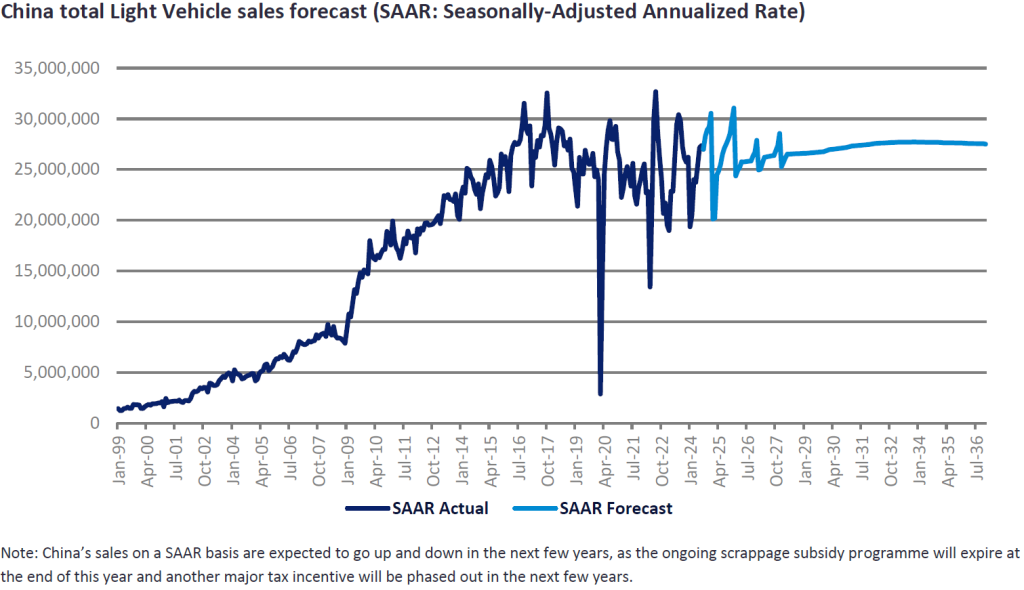

Future projections show that China’s rapidly ageing population and slowing economic growth will, at best, cause light vehicle sales to remain flat.

Our partner, Oxford Economics, expects that China’s government budget deficit as a percentage of GDP will surpass India’s in the future. This shift could have implications for each country’s ability to sustain economic growth and investment in the automotive sector.

Rising tensions between China and the West also pose a significant risk to the Chinese economy, further influencing the divergent trajectories of these two markets.

“And India can benefit from it,” says Sunako.

Specifically, India’s automotive sector may capitalise on these shifts as global supply chains and trade partnerships undergo realignment.

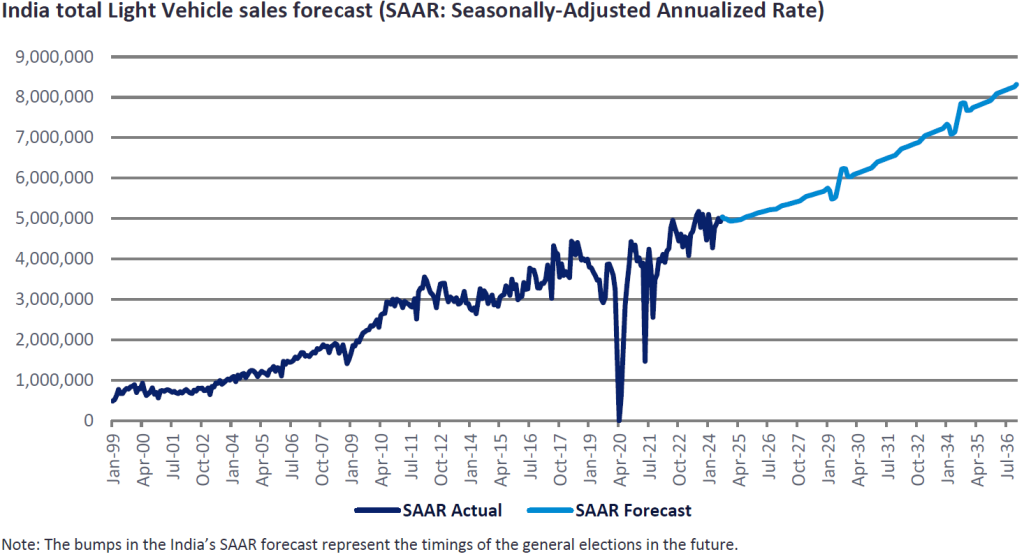

While India’s automotive market may not witness a dramatic take-off, it is poised for steady growth over the long term. In contrast, the Chinese market is assumed to have already reached its peak.

Our measured optimism for India’s medium to long-term light vehicle sales projections is driven by several factors.

Major OEMs are planning significant investments in India and are set to launch several new models aggressively, intensifying competition and offering more appealing and affordable options.

GDP growth is forecasted to average a solid 6.2% between 2024 and 2034, albeit slower than the pre-COVID ten-year period (2009-2019) of 6.9%. Real (inflation-adjusted) GDP per capita is expected to rise from US$2,200 in 2023 to US$4,090 in 2035. By comparison, China’s real GDP per capita is forecast to climb from US$12,000 in 2023 to US$19,000 in 2035.

India’s growing young population presents an advantage, but proper education and skill development are essential to fully harness this demographic potential.

Overall, we forecast India’s Light Vehicle sales will grow at a CAGR of 4-5% in the next decade, compared to 5-6% in the pre-COVID ten-year period. Passenger Vehicle density is expected to increase from about 44 units per 1,000 adults currently, to around 50 units in 2030, and 60 units in 2035.

However, we remain circumspect due to the market’s recent history, which has been marred by various one-time factors such as demonetisation in 2016, the introduction of the Goods and Services Tax (GST) in 2017, the credit crunch in late 2018 to 2019 (following a default of a major non-bank financial company), and the COVID-19 crisis.

Like many other emerging markets, the Indian auto market is likely to remain volatile. The economy’s structural challenges, such as a high government budget deficit, pose a downside risk to our forecast.

In summary, China’s automotive market has seen substantial growth, driven by targeted government policies, economic surpluses, and a centralised governance model. However, it now faces challenges from demographic changes, economic slowdown, and geopolitical tensions.

Even though India’s automotive market is not undergoing explosive growth, it is poised for steady expansion and may benefit from the shifting global landscape. This comparative analysis highlights the intricate interplay of economic policies, governance, and global dynamics in shaping industry outcomes.

Ammar Master, Director, South Asia, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.