Warren Buffet is often quoted for crediting the power of compounding as one of his success factors and famously compared building wealth through compound interest to rolling a snowball down a hill.

When it comes to making money, this isn’t someone to get into an argument with. So, what does Buffet mean by ‘compound interest’ and why is it so powerful?

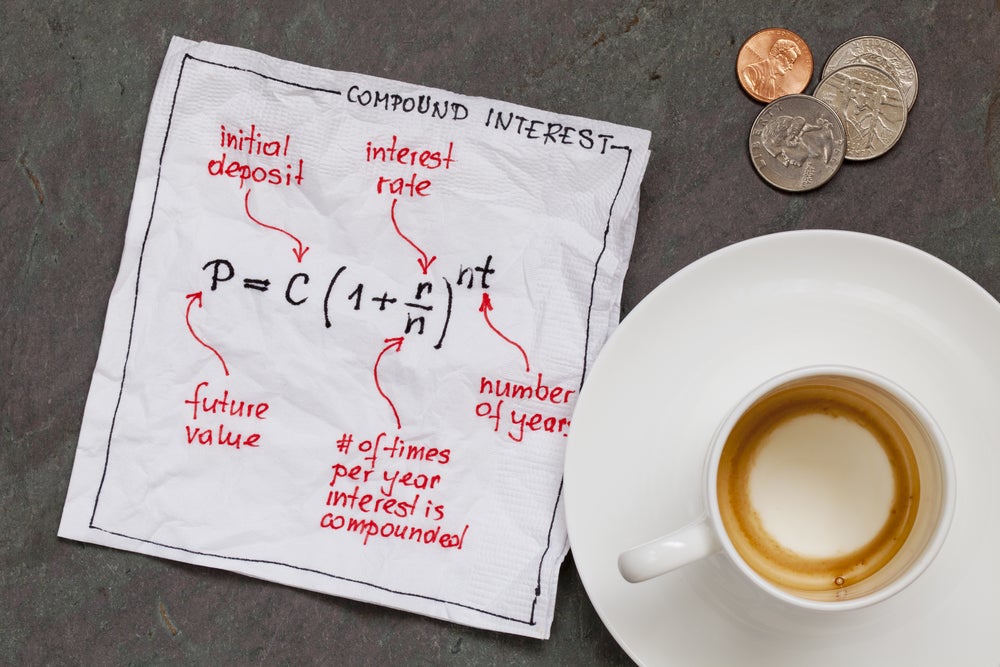

To put it simply, compound interest is the multiplier effect of interest being earned on interest. By reinvesting your earned interest alongside your original investment each year, an investor stands to generate stunning returns over a longer period of time.

When you lend money to an organisation – be it banks via savings accounts, companies via corporate bonds, governments via gilts, or peer-to-peer lending via an innovative finance individual saving accounts (IFISA) – you accumulate interest over time. This is usually given as an annual percentage rate such as 10%, which means, after lending £1,000, you would receive £1,100 back at the end of the year.

Now you have got your money back and more, you could:

- Reinvest your £1,000 and spend your £100 earnings;

- Reinvest your total £1,100 – and this is where things get interesting.

As you continue to reinvest your interest earnings, over time your wealth accumulates at an exponential rate.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAs you can see in the chart below, assuming that interest rates remain the same, reinvesting your interest earned each year alongside your original investment (£1,000) means that in ten years you will have more than doubled your money. In fact, you will have made £1,594.

Now, let’s suppose you not only invest your original £1,000 but keep adding an additional £1,000 to your investment each year.

After ten years, you have invested £10,000 but have made an additional £7,531.

Let’s take a look at what happens in years 18 to 20:

By the end of year 20, you have invested £20,000 but have returned £63,000, making a profit of £43,000!

This isn’t a get-rich scheme, this is just mathematics. Of course, every investment in any type of financial asset comes with associated risks and interest rates can vary, which should be taken into careful consideration, but understanding the fundamentals of compound interest can go a long way in helping investors maximise their returns over the long term.

Combining tax efficiency with compound interest

We have outlined how reinvesting interest payments into the underlying investment, rather than taking them as income, can help compound growth, but could this theory be combined with tax efficiency?

There are many different types of saving and investment vehicles that offer impressive rates of compound interest. ISAs, in particular, stand out as an effective ‘tax wrapper’ that allows investments to grow tax-free.

In short, they effectively shield your money from taxes that you would otherwise have to pay on both the income the investment generates, as well as taxes that would have been due on any increase in the value of the investment itself. Importantly, they also enable investors to compound tax-free returns.

ISAs explained

Every tax year you can put money into one of each kind of ISA. There is, however, one restriction. The amount of cash you are allowed to save or invest in an ISA in any one tax year – your individual annual ISA allowance – is set at £20,000 per year. The allowance can be split across several types of ISA, each of which has a different purpose and target audience.

Cash ISAs aren’t too dissimilar from a traditional savings account, and they offer an interest rate closely correlated to the base rate set by the Bank of England. You can open one of these at almost every major bank in the UK. ISAs have the great benefit of tax efficiency.

While this is still good news, typical interest rates in regular ISAs stand at around 3–4%, meaning that in the current high-inflation environment it can be difficult to strengthen the value of your returns over time.

Stocks and shares ISAs allow savers to hold equities and other conventional forms of investment within an ISA. These accounts are subject to greater volatility, particularly over the short term, and are more suited to investors who are happy to manage their own money.

The lifetime ISA is a longer-term tax-free savings account. Savers can put in up to £4,000 every tax year towards buying a home or planning for their retirement and the government will provide a 25% bonus on top of the savings. It is worth noting that there are a number of restrictions on the intended use of the savings and how much and when the cash can be withdrawn.

Finally, there are IFISAs. A lesser known relative of ISAs, these accounts benefit from a tax wrapper that allows ordinary savers and investors to hold more dynamic and innovative forms of finance such as peer-to-peer loans and debt-based securities.

IFISAs are classed as investments, meaning they have the ability to offer higher returns (which are not subject to tax) than traditional savings methods – such as the cash ISA.

In the property space, IFISAs have become influential in allowing ordinary investors to participate in high-grade property investment opportunities via lending platforms and reap the benefits of tax savings on any returns they receive.

Average returns on IFISAs have ranged between 7% and 9% over the past five years, according to recent data. The risk levels within IFISA investments vary from project to project and business to business; as with any investment, it is crucial that individuals do their own research and consider their financial goals, investment objectives and risk appetite.

As investors continue to navigate a tricky economic landscape, new trade-offs, correlations and risks are bound to emerge. By harnessing the power of compound interest and maximising tax efficiency, investors will stand a better chance of amplifying their potential returns and protecting their wealth against the eroding factors at play.