Covid-19 has demonstrated how vulnerable long and complex supply chains are. With manufacturing sites suddenly being shut down, when disparate but critical components were missing, managers started to look carefully at their supply chains. Due to industry 4.0 and the automation and robotisation that comes with it, labour costs are increasingly not the key cost element any longer, hence reshoring is becoming more of an option. Accordingly, we are already seeing indications that the number of jobs being created by reshoring surpassed the number of jobs created by FDI in the US in 2020.

In this article, however, I seek to look much further ahead, beyond simple supply chain reconfiguration, and estimate what these developments might mean for FDI in the future. While this is only one of many possible scenarios of how the world could turn out, it certainly isn’t an unrealistic one.

How Covid-19 changed the business world

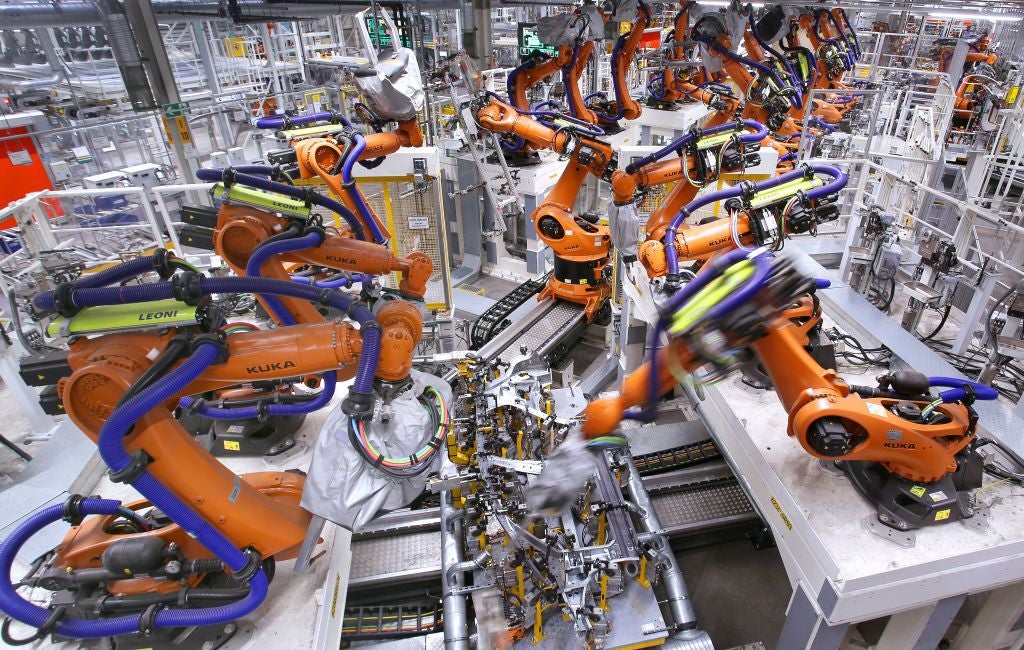

In 2019, we stood at the cusp of industry 4.0 becoming a manufacturing reality. We talked about digitalisation, and put sensors into our production machines. With Big Data analytics, the most avant-garde companies started to understand their processes much better, toyed with predictive maintenance and automated quality control. Then Covid-19 changed the world. It forced us to move into digitalisation much faster and much more holistically than most of us had envisioned in our wildest dreams – and at a rate ten times faster than we had thought possible.

Make no mistake, these changes are here to stay. These are the days when the ‘new normal’ and the ‘future of work’ is being determined. These changes invariably will have an impact on how we do business, where we do business, and how we trade with each other.

In 2019, we stood at the cusp of industry 4.0 becoming a manufacturing reality. We talked about digitalisation, and put sensors into our production machines. Then Covid-19 changed the world.

Let’s be honest, right now we are still amateurs in the game of industry 4.0, but imagine what happens when these capabilities of measurement and analysis in a production context are used at scale and connected to the other functions of value generation. Real-time insights into production tolerances allow for optimised dimensions and raw material usage; machine settings and production speeds will be determined, and continuously monitored and improved, by Big Data analytics.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData[Keep up with Investment Monitor: Subscribe to our weekly newsletter]

Think about the entire value generation process: orders coming in via electronic data interchange, the enterprise resource planning system breaking these down into their respective bill of materials, ordering raw materials, optimising production cycles and machine loading, and autonomous vehicles picking up the finished goods and bringing them to the loading docks, where autonomously driven lorries already wait, given that the smart factory system had accurately calculated the exact time when the order would be completed.

The only thing not appearing in this story – at least not in meaningful numbers – is humans: those error-prone, weekend-loving factors of production, who also tend to be very insistent on salary increases each year. Irrespective of the social implications this vision has (which for the sake of this article we will leave aside), what would such a scenario mean for foreign direct investment (FDI) and FDI location choice?

How industry 4.0 will impact FDI site selection

The old equations of location choice parameters are suddenly becoming obsolete. A large pool of sufficiently qualified labour, now a key determining factor, will probably become irrelevant – hence also proximity to cities and public infrastructure. Proximity to airports, to quickly fly in specialists in case of a technical problem, will now be solved via virtual reality glasses and drones flying in the required spare parts. Tech-savvy and cash-rich companies (think Apple or Google) could presumably finance the venture out of their own cash reserves, so not even a well-functioning banking system is needed anymore.

If you only exist at the end of a laptop screen, it doesn’t matter whether you sit in western Europe or northern India.

A 5G-data-handling infrastructure, however, will be key. To get all the order data, virtual reality and real-time plant surveillance data processed, constant upload/download contact to the cloud will be key. And so will, presumably, a sufficiently pliant government, with a low-regulation, low-tax, no-questions-asked approach, along with no visa-hurdles to get the 50 or so tech specialists from anywhere in the world in to run the plant. The only local employee will presumably be the cleaner sweeping the floor every other day.

A white-collar wave of outsourcing

Another big phenomenon of the Covid crisis for most medium to high-skilled office workers has been that of ‘working from home’. And while it was excellent not to have to go out into this infected world and be able to answer emails still in your pyjamas, think again. The cleaner needs to be where the plant is, but if you only exist at the end of a laptop screen, it doesn’t matter whether you sit in western Europe or northern India. Working remotely can certainly be shifted offshore. So, while blue-collar manufacturing jobs might be coming back (albeit only in miniscule doses), white-collar jobs might be going abroad, as it clearly doesn’t matter whether you have a German bookkeeper in Hamburg, or an Indonesian one in Jakarta – that is, if you are old-fashioned enough to still have a human bookkeeper to start with.

People will find that there is a benefit in your task not being that easily separated from the physical location where it is performed. Unsurprisingly, the Googles, Microsofts and Twitters of this world are at the forefront of making a permanent remote working vision a reality. Essentially this will mean that we won’t have work migrants flowing across our borders any longer, at least not those with useful skills or decent education, but we will see an emerging class of online tele-migrants, who, irrespective of where they are located, compete with local workers for jobs, especially in those tasks captured under the new term of ‘servicification’. Accordingly, companies will suddenly feel far less strain in finding qualified staff.

With nearly everyone in the factory having been made redundant, it is unlikely that nation states will get away without some form of base income to keep the masses reasonably quiet. To generate this amount of money, you will need to tax value generation (as you can hardly tax the unemployed). So, we will presumably see a world of economic blocs: an Americas bloc, a European economic zone and an Asian bloc. What you want to sell within this bloc will have to be produced there (so as to allow nation states – or these larger blocs as a whole — to at least generate some tax revenue).

The rise of the regional blocs

We are seeing the first signs of this already. While we can observe rising levels of protectionism, and trade restrictions far outpacing trade liberalisations in 2020, we also see a shift from multilateral to regional trade policies. An example of this new – and quite successful – regionalism is RCEP, which is driving the integration of the Chinese economy with those of the Asean member countries. RCEP, however, is an agreement that only formalised what had already been emerging in the figures for quite some time. The share of exports/imports of the US with China dropped from 17% in 2000 to 12% in 2020, while at the same time the share of Asean members doubled from 7% to 14%, now surpassing the EU as well as the US as trading partners.

In the absence of a global level playing field, regional bodies, seeking to enforce a local minimum standard (such as that the EU is still seeking to establish), are our next best hope. Otherwise, companies, totally unbound by geography, would pick obscure places and sidestep taxation entirely.

So, as a nation, are you prepared for this reorientation of trade and investment strategies? Are you ready to compete with the world? Do you offer limitless broadband and tech-savvy specialists, who not only speak English and Mandarin but also Python and R? So that nationals of your country at least capture a part of the tiny share of jobs still needed to be performed by humans, or that those managing the firms are still up to the task of deciding on cybersecurity and artificial intelligence tools.

Are you as a nation, in laws as well as know-how, transitioning to AI and digitalisation fast enough? Asia certainly is setting quite an impressive pace in terms of its workforce adapting to the new realities of automation, digitalisation and the application of fintech technologies. (Where can you pay for your coffee simply by showing your face to a camera or a fingerprint, other than in Asia?) Are you as a nation in fact chasing the right sort of companies that get you into the future – or is your president still dreaming of coal power stations and steel mills? Can you even speak to these companies of the future in a reasonably competent way?

If such a vision comes true, not being part of a bigger bloc could be lethal for your national well-being. So, Brexit might turn out to be an even more injudicious decision than it appears to be today. Compared with this, the UK financial industry largely decamping to Frankfurt, Dublin and Luxembourg, or Dyson and Ineos, once ardent supporters of Brexit, relocating out of the UK, will be small fry. We will all be in for a rough ride – we better get ready for that.

Featured photo by Ronny Hartmann/AFP via Getty Images.