European stock markets are significantly more vulnerable to geopolitical risks than their US and Japanese counterparts, according to a new report by global risk intelligence company Verisk Maplecroft.

Maplecroft’s research focused on markets’ exposure to bilateral disputes that could result in military or violent confrontation. They mapped these vulnerable geopolitical hotspots against the assets of hundreds of companies listed on Europe’s major stock markets, Japan’s Nikkei 225 and the US’ S&P 500.

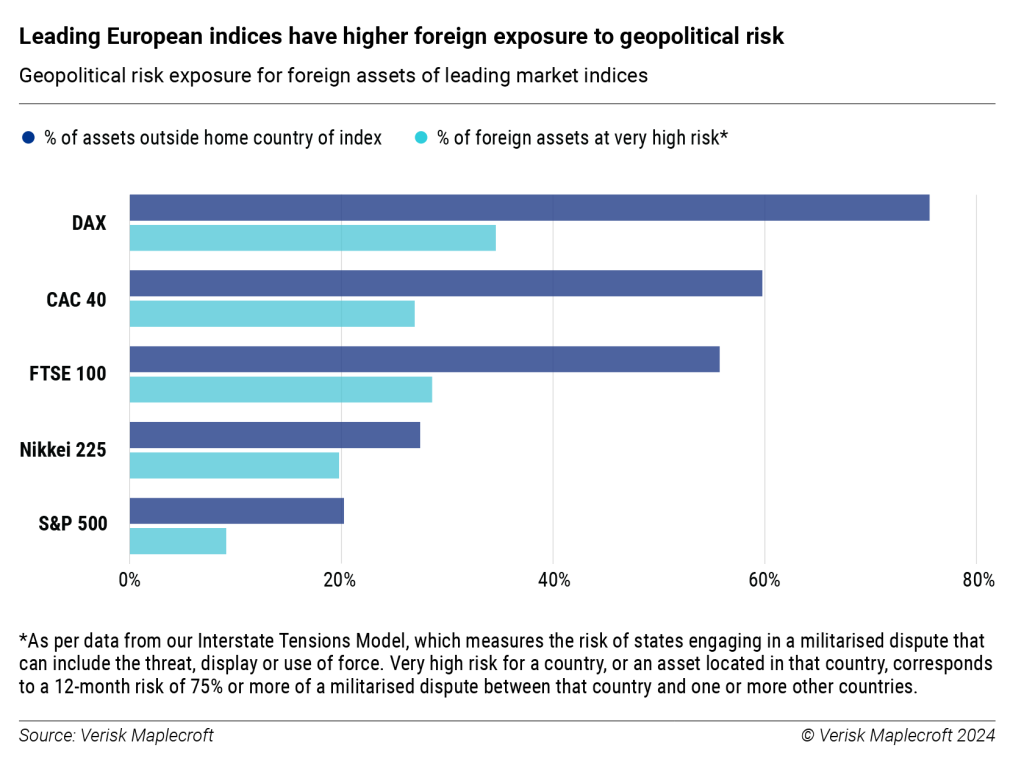

Between 50% and 75% of European companies’ assets are located abroad, and half of these assets are located in locations that Maplecroft’s model classified as having a “very high” geopolitical risk. Germany’s DAX is the most susceptible to these risks.

While all countries face risks from domestic disputes, the research found these are usually well accounted for by investors. Global footprints are less so. The report’s Asset Risk Exposure Analytics (AREA) shows that 76% of the assets in DAX are outside of Germany. For France’s CAC it’s 60% and for the UK’s FTSE 100, it’s 56%.

Within 76% of the DAX’s assets abroad, 35% are located in geopolitical hotspots facing a “very high” risk of militarised dispute. For France, the figure is 27% and for the UK 29%.

Germany, typically Europe’s economic powerhouse, has been facing challenges including stagnant growth and a downturn in its legacy automotive industry. Political woes that have led to the calling of a snap election in 2025 have also left the traditional European leader weakened.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFor the S&P 500 and Nikkei 225, the percentage of companies exposed to “very high” geopolitical risks is 9% and 20%, respectively.

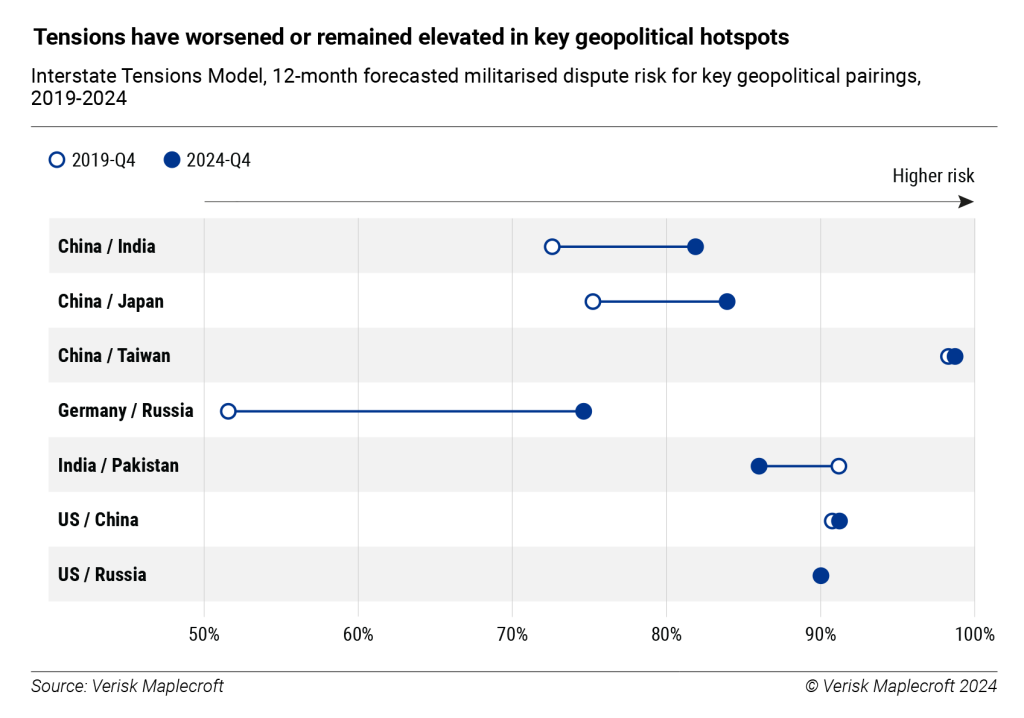

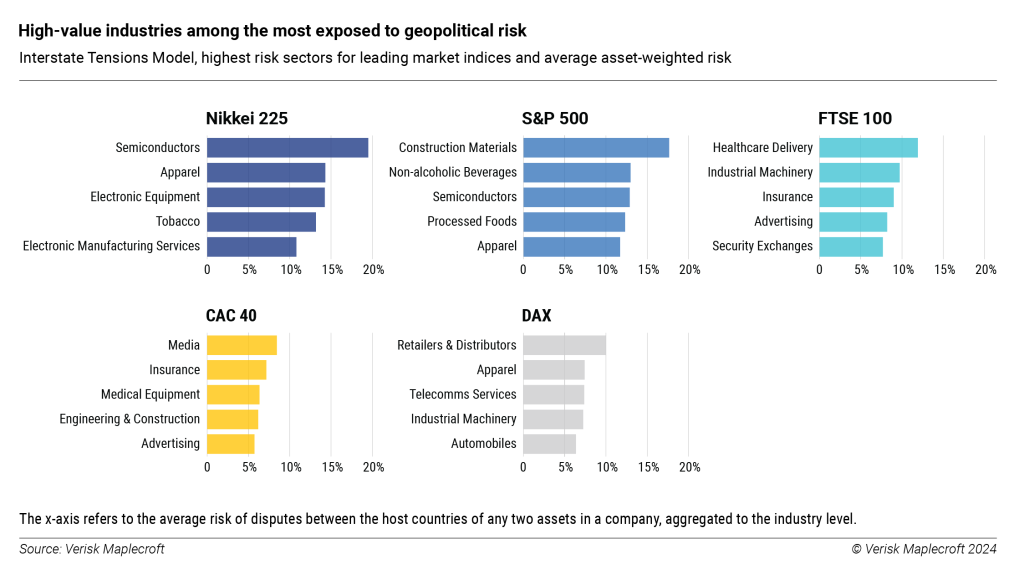

While the US and Japanese markets are less exposed to these risks than European stocks, the report found that their concentrated focus on tech stocks still leaves them vulnerable to geopolitical risk. This is particularly the case for geopolitical shocks in Asia, where the research found that the China-Taiwan conflict has one of the highest risks for a militarised dispute in the next 12 months.

The region is increasingly becoming crucial in the semiconductor supply chain, with many investments by major tech companies forecasted in the next few years.

James Lockhart Smith, Verisk Maplecroft’s head of markets, says: “Aside from their sensitivity to energy prices, companies in these market indices are mostly insulated from the impacts of the conflict in the Middle East due to their low concentration of operations in the region.

“But escalations in the conflict between Russia and Ukraine sent jitters through the markets in November and sharpened investors’ minds – yet again – to the risks of a major geopolitical event.”

Certain industries characterised by globally extended supply chains, such as the apparel and retail sectors, are particularly vulnerable to supply chain disruptions due to heightened geopolitical risks. The apparel sector felt the effects of this in the summer when Bangladesh’s long-time autocratic ruler was ousted. The events unfolded relatively quickly, leaving the industry with little time to prepare and resulting in the loss of hundreds of millions of dollars.