Samsung Electronics will challenge and potentially supplant Taiwan Semiconductor Manufacturing Company (TSMC) as the world’s largest and highest-valued semiconductor producer, according to analysts.

Rory Green, head of China and Asia research at research company TS Lombard, told GlobalData’s Instant Insights podcast that TSMC makes Taiwan “the critical manufacturing point in the global semiconductor supply chain” while South Korean chaebol Samsung is “about a generation behind TSMC but with more resources”.

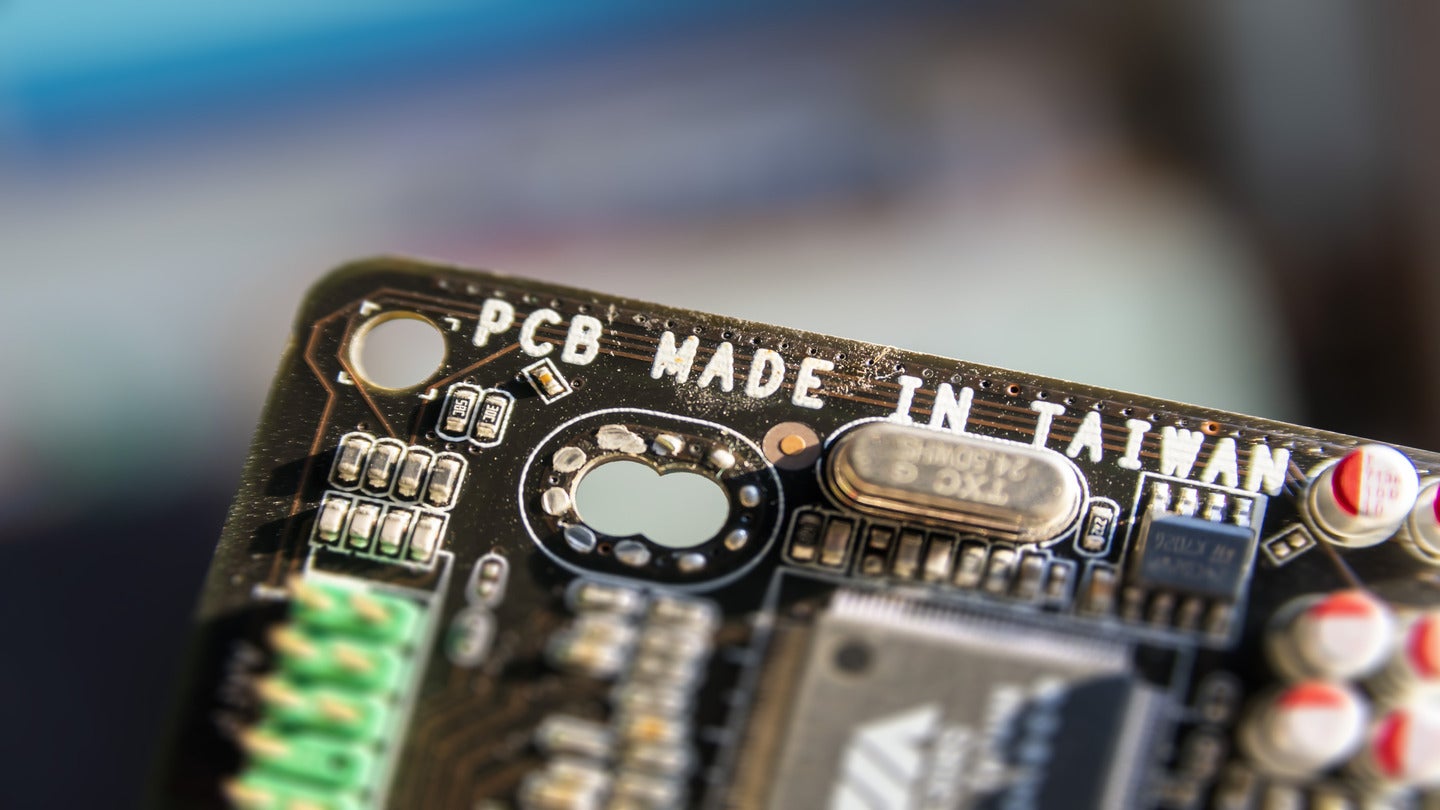

Semiconductors, used in technologies from electric vehicles to smartphones, as outlined in GlobalData’s Sand To Silicon – How Semiconductors Are Reimagining The Digital Future report, and described by Green as the “oil of the modern economy”, will become increasingly crucial amid the green energy transition.

A shift away from Taiwan in the global semiconductor market would jeopardise Taipei’s ‘silicon shield’ against Chinese aggression as the West’s strategic interests in the island’s independence from China could waver.

Green’s projections come four months after Kyung Kye-hyun, head of Samsung’s semiconductor division, promised to overtake TSMC by 2028.

“To be honest, our foundry technology is one or two years behind TSMC’s,” Kye-hyun said during a lecture at Kaist, a leading science and technology institute in South Korea. “However, once TSMC joins us in the race for two-nanometre technology, Samsung will lead the way. Within five years, we can surpass TSMC.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataTSMC still dominates the market – for now. In the second quarter of 2023, Samsung’s semiconductor foundry business posted $3.23bn (4.28bn won) in revenue, a quarter-on-quarter increase of 17.3%. TSMC, meanwhile, posted second quarter revenue of $15.66bn (T$500bn).

While China is interested in Taiwan’s semiconductor riches, Beijing has long claimed it as part of Chinese territory on cultural and historical grounds. Western interests are largely a counterpart to Chinese influence and revolve around semiconductor manufacturing.

Attitudes in Taiwan are largely pro-sovereignty. In its biennial National Defence Report (2023), released on 12 September, the Taiwanese Defence Ministry accused China of bolstering air power along its Taipei-facing coast and ramping up cyberattacks on the island.

Upcoming presidential elections in January 2024 could see a “a reversal of efforts to move closer to the US if an opposition candidate wins”, according to Green. Despite this, current frontrunner William Lai Ching-te is vice-president of incumbent Tsai Ing-wen of the Democratic Progressive Party. He is an outspoken critic of Beijing, and says Taiwan’s sovereignty is “a fact”.

With the landscape of the global semiconductor industry poised for considerable change, one of the key issues facing the victor of Taiwan’s election will be ensuring that TSMC remains at the cutting edge of this crucial technology.