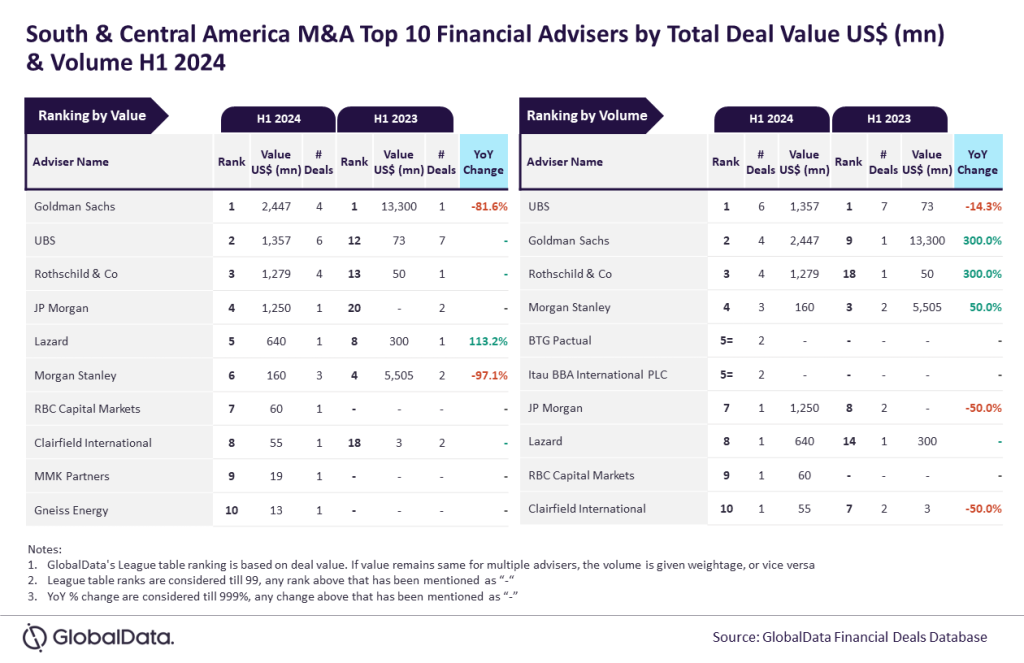

Goldman Sachs and UBS were the top mergers and acquisitions (M&A) financial advisers in South and Central America during the first half (H1) of 2024, according to GlobalData’s latest league table.

The leading data and analytics company ranks advisers by the value and volume of M&A deals on which they advised.

According to its financial deals database, Goldman Sachs was the top firm in terms of deal value by advising on $2.4bn worth of deals during the period. USB led in terms of deal volume by advising on a total of six deals.

“Both Goldman Sachs and UBS were the top advisers by value and volume in H1 2023 and managed to retain their respective leadership positions in H1 2024, despite suffering setbacks,” said GlobalData lead analyst Aurojyoti Bose.

“Interestingly, while Goldman Sachs, apart from leading by value, occupied the second position by volume in H1 2024 as well, UBS also occupied the second position by value, apart from leading by volume.”

UBS came second in terms of deal value by advising on $1.4 billion worth of deals, followed by Rothschild & Co with $1.3bn, JP Morgan with $1.3bn, and Lazard with $640m.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMeanwhile, Goldman Sachs occupied the second position in terms of volume with four deals, followed by Rothschild & Co with four deals, and Morgan Stanley with three deals.

Top M&A legal advisers

Among M&A legal advisers, Clifford Chance and Simpson Thacher & Bartlett led GlobalData’s South and Central America rankings for H1 2024 measured by deal value and volume, respectively.

Both companies recorded a significant rise in position from last year. Clifford Chance was propelled to the top of the ranking by advising on $6.7bn worth of deals.

“Clifford Chance registered a massive jump in the total value of deals advised by it during H1 2024 compared to H1 2023,” said Bose. “Consequently, its ranking in the value chart also took a big leap from 29th position in H1 2023 to the top spot in H1 2024. Involvement in the $5.8bn Brookfield-Neoen acquisition deal announced in May 2024 was pivotal for Clifford Chance in experiencing this massive jump.”

McCarthy Tetrault came second by deal value with $6bn worth of deals, followed by White & Case, Barros & Errazuriz Abogados, and Alcaino Abogados with $1.3bn each.

Measured by volume of deals, Simpson Thacher & Bartlett rose from 16th place in H1 2023 to the top position in H1 2024 by advising on five deals.

Posse Herrera & Ruiz Abogados came in second place with four deals, followed by Barros & Errazuriz Abogados with three deals, Skadden, Arps, Slate, Meagher & Flom with three deals, and DLA Piper also with three deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.