London ranks as the UK’s most competitive region regarding inward investment attraction. Its score of 1.69 placed it just ahead of Northern Ireland (1.64). London’s score means that it is attracting 1.69 times its fair share of national greenfield foreign direct investment (FDI) projects given the size of its economy.

London accounts for just under one-quarter (23.3%) of UK GDP, while it receives 39.4% of the country’s inward greenfield FDI.

The UK’s capital and business hub was home to 411 international company expansions in 2022. It ranks as the third-largest FDI recipient city globally behind Dubai and Singapore.

Kadans Science Partner and Canary Wharf Group formed a joint venture to announce the building of a new $552m GIA life science-focused, wet lab-enabled building at Canary Wharf. Meanwhile Mphasis, an India-based provider of IT solutions specialising in cloud and cognitive services, announced plans to invest $6.5m (Rs5.35bn) to open a new office, which will create 700 new jobs.

Northern Ireland punching above its weight

The UK’s smallest region by population, Northern Ireland, attracted 39 greenfield FDI projects in 2022. Southern neighbour Ireland and the US were key source markets for FDI into Northern Ireland. Combined, these two countries accounted for more than half (56%) of inbound investments in the region.

US-based digital company Insider Inc announced plans to set up a new technology and product hub in Belfast, generating 50 jobs. Another US company, Harness, opened a new engineering centre that will create 80 jobs over three years.

Although the number of projects into Northern Ireland is lower than nine of the 11 other UK regions, its GDP is the lowest of any UK region.

Only three UK regions 'in profit' on FDI

Scotland was the only other UK region to score more than one in the index. Scotland’s score of 1.23 reflected that it accounts for 9.2% of the UK's inward investment projects, while accounting for only 7.5% of the country's GDP. All other UK regions scored below one, meaning they receive a lower proportion of UK inward investment than one would expect given the size of their economies.

Scores change over time

There is little variation in the proportion of national GDP accounted for by each UK region between 2019 and 2022. However, there are notable changes in volumes of inward investment projects by region, by year. Greater London and Northern Ireland are the only regions to have an inward investment regional competitiveness index score above one in each of the past four years. Scotland scores above one in three of the past four years.

Some regions are more volatile. The North East, the East Midlands and the West Midlands have experienced regional competitiveness scores above and below one across the period, while the East of England and Wales have also been volatile; however, in each year their scores have been below one.

Other regions also had scores consistently below one, such as the North West, Yorkshire and the Humber, the South East and the South West, but each of these was less volatile in their yearly distribution.

Methodology

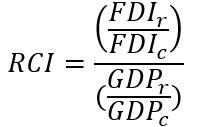

A regional competitiveness index (RCI) score is calculated for each region. The calculation is based on the number of inward greenfield FDI projects a region receives as a share of the country total. This value is then divided by the region’s proportion of economic output (GDP). A score above one indicates that the region is receiving more FDI than would be expected given the size of its economy (it is overperforming). To the contrary, a score of less than one indicates a region is underperforming in terms of the amount of inward investment it receives given the size of its economic output.

The RCI is where FDI is the number of inbound greenfield FDI projects, GDP is gross domestic product, r is the region and c is the country.