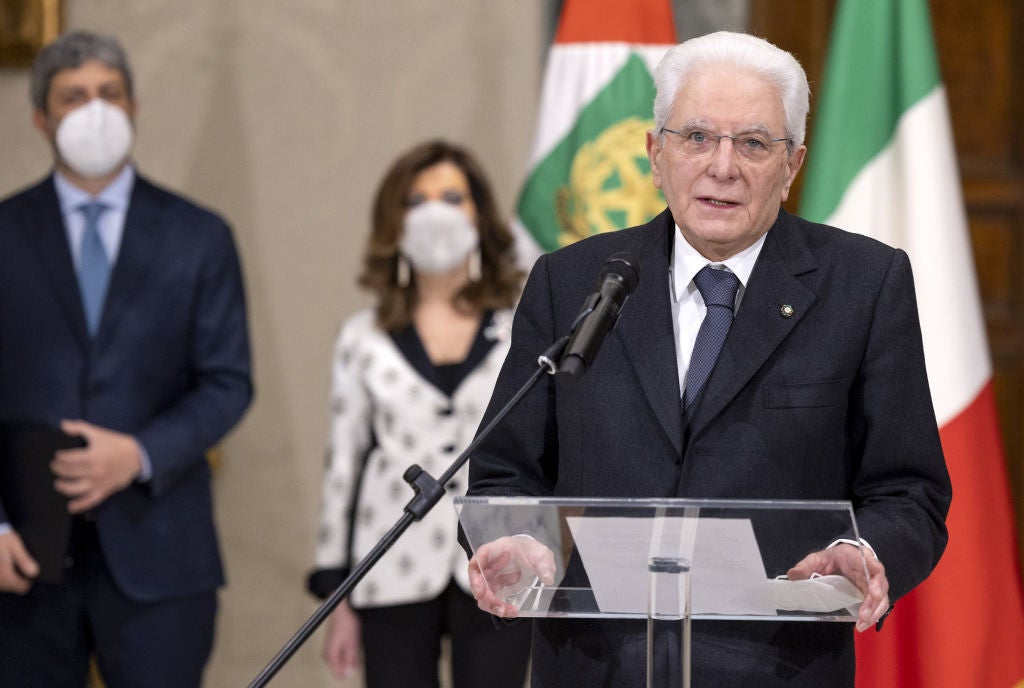

Nothing must change so that everything can change. Italy’s presidential election result seems to have reversed Tomasi di Lampedusa’s famous quote from The Leopard as 80-year-old Sergio Mattarella was re-elected with a majority of 759 votes after seven inconclusive consultation rounds.

However, while the markets have generally hailed the result as a reassuring guarantee of the status quo, the inability of Italian political parties to produce an alternative is a sign of internal fractures and – potentially – of instability in the months to come.

President Mattarella had initially kept himself out of the race after saying that he had “other plans”, but after a week of embarrassing political games that led nowhere, Prime Minister Mario Draghi asked for a private meeting to convince Mattarella to remain in his post.

Draghi himself had signalled that he was up for the job, which would have triggered the process of finding a new prime minister and the danger of an early election – clearly an unappealing scenario for members of parliament, who might end up losing their seat in the process.

Italy saw negative inflows of €338.7m ($388m) in 2020, according to UNCTAD’s World Investment Report 2021. Much of the country’s appeal to foreign investors in the year to come will depend on the government’s steadiness and its ability to deliver much-needed reforms.

Italy recorded 159 inbound greenfield foreign direct investment projects in 2020. That was down 15% compared with 2019 figures. This was around the same decline experienced globally. Italy’s top inbound sectors are textiles, software and IT services, and business and professional services. Combined, these three sectors account for one-third of all inward greenfield investment into the country.

Markets are happy with Italy’s status quo

Everybody keeping their parliamentary seats and the stability that this appears to bring spells good news for the markets.

“Political stability is going to be a precious asset as the world economy normalises and economic policy needs to break from ‘all-out’ accommodation,” says Gilles Moëc, group chief economist at AXA Investment Managers. “The status quo that has prevailed in Italy, with Mattarella remaining president of the republic and Draghi prime minister, is the best possible outcome as the European Central Bank’s [ECB’s] support to the bond market is about to fade.”

Indeed, Italy needs to deliver structural reforms to unlock nearly €200bn of EU funds and so far Draghi has managed to keep the country on this course while handling a very diverse coalition.

The bond market especially was particularly weary of the prospect of Draghi becoming the new president and leaving a void in the prime minister’s seat.

“Italian spreads have been under pressure in recent months, driven in part by the commencement of the gradual reduction in support from the ECB, but also by concerns around whether Draghi would remain as prime minister following comments he made before Christmas that indicated a fairly clear desire to run for president,” says David Chappell, senior portfolio manager, fixed income at Columbia Threadneedle Investments.

“We have seen some relief in spreads this week, after a week of failed attempts to find a successor to Mattarella… More importantly, of course, Draghi also remains in place, holding the coalition together as he guides the economy through recovery and structural changes made possible by the European Relief Fund.”

But has Draghi lost his grip?

All parties, except for the far-right Brothers of Italy, voted for Mattarella to keep his job as president. However, this is not necessarily a sign of consensus and a lack of tension in the Italian political arena.

Matteo Salvini, the leader of the Northern League – one of the coalition parties alongside the Five Star Movement (5SM) and the Democratic Party – appeared to be one of the biggest losers after he presented a long list of candidates who were promptly shot down during consultations.

Draghi himself can hardly call this election a success and, even less, an act of confidence in his leadership.

“Draghi remains prime minister, but it is clear that political parties went into ‘anyone but Draghi’ mode when it came to electing a new president. We cannot pretend this never happened, and Draghi, too, knows this,” says Francesco Galietti, co-founder and CEO of Policy Sonar.

The main reason lawmakers gave for not backing his candidacy was that it would trigger an unnecessary and potentially damaging leadership contest for the role of prime minister. The reality is that Draghi is a strong prime minister who listens to everyone but tends to decide on his own and many want to make his life harder in the last year of his mandate.

“Mattarella’s re-election means that Draghi will stay put as prime minister and that almost certainly no snap general elections will take place before the end of the current parliamentary term in spring 2023,” says Wolfgango Piccoli, co-president of Teneo Intelligence. “While at first sight this may suggest that the status quo has prevailed, the reality is that the overall political backdrop has become less supportive for the executive led by Draghi, which is facing a daunting task in the year or so left before the next general election.”

Nicola Bilotta, senior fellow at Istituto Affari Internazionali, adds: “Draghi will face a tough year ahead. While his government now needs to accelerate to approve reforms and implement the National Plan For Recovery and Resilience, Draghi will have a hard time controlling the ruling majority. The Northern League and the 5SM are in tatters. Their internal leaderships have come out significantly weakened and their parties are internally split. This does not play well for Draghi. With the general election in 2023, the risk is that the League and the 5SM will adopt an electoral campaign attitude, hindering Draghi’s plan of reforms.”

Foreign investors should remain vigilant over the Italian political scenario in the ensuing months as it will come with very few certainties.