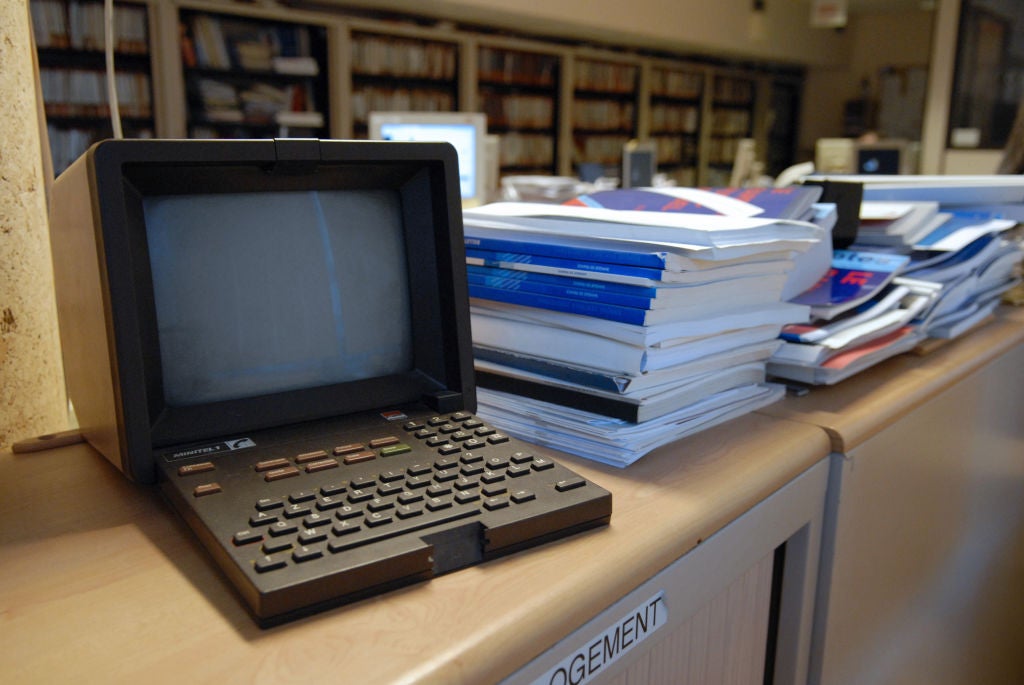

Among the obsolete technology applications of the past 50 years, France’s Minitel is unremarkable yet perhaps emblematic of the diverging fortunes of the European technology sector and US Big Tech.

The Minitel was a small terminal running an online monochrome video text service, a rudimentary precursor of internet services that enabled the booking of tickets, messages and gaming.

In terms of technology, it was an evolutionary cul-de-sac. Meanwhile, the US was busy working on applications using a better, more scalable version of connectivity: the internet. California’s cluster of high-tech companies and its collective entrepreneurial mindset created the conditions for the organic growth of what became known as Silicon Valley.

There has long been a debate over whether the French government’s insistence on persisting with its homegrown technology slowed the country’s adoption of the internet. There were 810,000 Minitel terminals still in operation in the country in 2012. As hard as widespread adoption is to achieve, it seems that in a continent that moves like a tanker, the opposite is also true.

The diverging trajectories of Europe’s technology sector and the emergence of US Big Tech supremacy continues to baffle and dismay Brussels bureaucrats.

Europe needs its own Silicon Valley

The diverging trajectories of Europe’s technology sector and the emergence of US Big Tech supremacy continues to baffle and dismay Brussels bureaucrats. From Europe’s starter position of internet pioneer – let’s not forget that the first iteration of the World Wide Web was developed by Englishman Tim Berners-Lee at Switzerland’s CERN – Europe has failed to catch the tail of US Big Tech and establish its own centre of gravity to compete with Silicon Valley.

[Keep up with Investment Monitor: Subscribe to our weekly newsletter]

Where is the European Amazon? Google? Microsoft? The lifeblood of unicorns – tech companies valued at more than $1bn – is access to capital. Although Europe accounted for about one-quarter of global GDP in 2020, its share of global tech venture capital investment was still only 13%, according to data from Dealroom.com. US tech still attracts more than half of all venture capital investment globally, despite accounting for 26% of global GDP and just 5% of the world’s population.

However, instead of addressing this funding disparity, the European Commission has opted to take aim at US Big Tech with a raft of proposed regulation (the Digital Markets Act and Digital Services Acts) targeting its very business model and imposing potential penalties of up to 10% of annual revenue. While there is consensus among global policymakers that regulation is required to keep the increasing dominance of Big Tech in check, the EU may not have got the balance of remedies entirely correct.

A shift in investing mindset is also needed. European tech companies founded in the past five years contributed just over one-third of total capital raised (37%) in Europe in 2020 because more established companies are still the ones with access to large sums of capital, according to Atomico’s 2020 State of European Tech report.

With the right kind of public sector support, Europe has huge potential. Institutional investors from Europe and around the world poured three times more money into Europe’s tech industry in 2020 than they did five years previously, according to the State of European Tech report. As the European technology ecosystem continues to mature, the share of funding from government agencies is declining and now accounts for less than 10% of venture capital funds raised in Europe’s most mature markets.

Europe’s disparate country tech ecosystems are all at very different stages of development, demonstrated by the levels of cumulative per capita investment by country across the region. By helping European member states to catch up with the per capita investment levels of their most developed peer states, the potential to reach the kind of investment levels seen in the US is not only possible but within reach.

To realise its potential as an engine of economic growth, European tech needs supportive regulation and government action. According to the State of European Tech report, EU governments responded rapidly to support start-ups in the wake of Covid-19, injecting $11bn in relief funds across Europe, although the impact of this investment is not yet clear. The report found that positive policy initiatives are emerging, including on visas and employee stock options, but more education and awareness-raising is needed: only 20% of founders and investors believe the concerns of start-ups and scale-ups are being heard by European policymakers, according to those surveyed in the report.

A collaborative approach

Let Brussels come up with a regulatory framework for the tech sector and let it be a more collaborative approach that takes account of the fact that as harmful as monopolistic practices can be, the EU should not take an isolationist stance in a sector that by its very nature is cross-border. Heavily regulating US Big Tech is not the answer to the problem of cross-border society trying to deal with cross-border supply by big companies. This is not a problem unique to the US and Europe and the actions of the European Commission are being watched and will set the standard elsewhere.

Heavily regulating US Big Tech is not the answer to the problem of cross-border society trying to deal with cross-border supply by big companies.

The European Commission’s proposal is no doubt a genuine attempt to curb anti-competitive behaviour, but, as always, the devil is in the detail. It must strike the right balance with the legislation or risk stifling innovation, or worse creating an innovation gap between Europe and other jurisdictions keenly awaiting US Big Tech investment.

For Europe to fairly and efficiently implement legislation to protect its own economic interests is understandable. And many governments, including the US, hold the view that the global influence of Big Tech needs to be reined in. However, a head-on collision between Brussels bureaucrats and Silicon Valley’s scions serves neither party. With the growth potential of emerging markets, Europe should be wary of becoming a technology graveyard where the Minitel now lies.

Home page photo of the Minitel by Maud Vandepoele/AFP via Getty Images.