The global mobility market is on the brink of immense transformation as electric vehicles (EVs) are more widely adopted, and the potential applications of autonomous vehicles (AVs) and drones are more thoroughly explored. The pace of the market has been slow in recent years, hampered by supply chain issues, including a worldwide shortage of semiconductors that limited the number of automotive vehicles put out to market. However, as technological advancements pick up their pace the market is expected to experience new growth.

Notable for its growing significance in the global mobility market is the Middle East. Historically the priority of energy and defence investment, countries such as the United Arab Emirates (UAE) are redefining themselves as world-leading innovation hubs, keen to put the latest tech developments into practice. With a regulatory environment that aims to facilitate AV, EV, and drone testing and adoption, Dubai is at the forefront of the new mobility wave, with innovative economic zones such as Dubai Silicon Oasis (DSO) providing the ideal environment for disruptive entrepreneurs in the mobility sector to scale their businesses.

The global mobility market in 2024

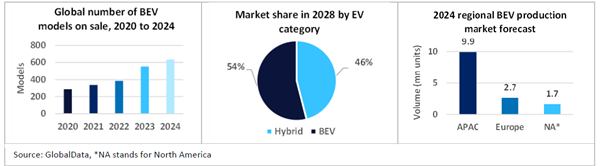

In the EV market, growth has been rapid. BEVs accounted for 9.4% of all new light vehicle production in 2022, a huge leap from 0.8% in 2017. By 2025, GlobalData forecasts that global BEV production will hit 28.3 million units, 28% of the total light vehicle market. This growth is set to be driven by increasing government regulation as environmental, social, and governance (ESG) legislation becomes more stringent. EV production will accelerate in line with demand, as EV charging infrastructure increases and businesses and consumers choose to purchase new electric models over outdated petrol ones.

GlobalData forecasts that the global EV market will see a compound annual growth rate (CAGR) of 16.1% to reach 53.9 million units by 2028 as the desire for lower emissions vehicles drives high sales. Within this same timeframe, it is predicted that battery electric vehicle (BEV) production will overtake that of hybrids (HEVs) to become the leading electrified driving option on the market, with BEVs holding a 54% market share by 2028. China currently leads in EV production, but the adoption of electric-powered mobility is increasing worldwide, driven partially by government incentives. In Dubai, for example, EV drivers can charge their cars for free, park without charge, and benefit from lower interest rates on EV loans.

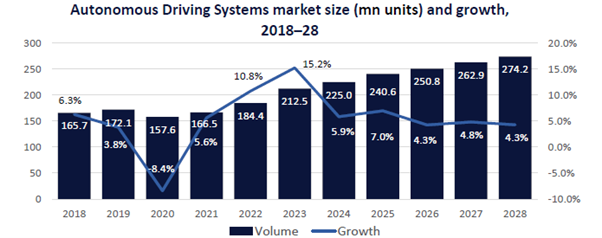

Meanwhile, GlobalData intelligence finds that the AV market experienced growth of 15.3% in 2023 and is expected to record a CAGR of 5.2% from 2023-28, with 274.2 million units predicted to be sold in 2028. Artificial intelligence (AI) is set to boost vehicle design and testing through simulation, sensor fusion, system learning, and risk assessment. AI will also be critical in analysing the huge datasets amassed through autonomous test drives, helping to analyse performance and improve reliability. AI software can learn from daily operations to improve advanced driver assistance systems (ADAS), including collision detection, lane-keeping assistance, adaptive cruise control (ACC), and parking assistance. Generative AI has a further application in creating a vast range of real-world driving conditions and scenarios to test AV performance.

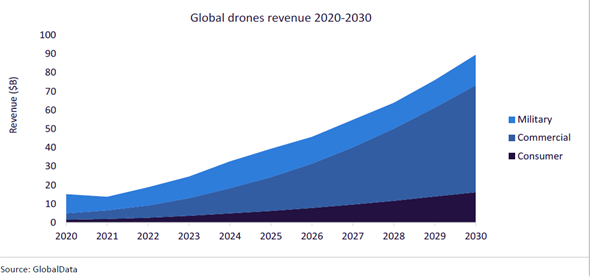

Another tech innovation changing mobility across the world is drones. GlobalData predicts that the global drone market will reach $89.6 billion by 2030, up from $13.7 billion, largely driven by commercial rather than military applications. Revenue from these commercial drones will surpass military sales by 2025 thanks to a favourable regulatory environment and the technical capabilities of beyond visual line of sight (BVLOS) operations. Drone transport has the potential to revolutionise mobility by transforming how deliveries are carried out, and in the future will even be able to carry passengers.

MEA region shows significant mobility market potential

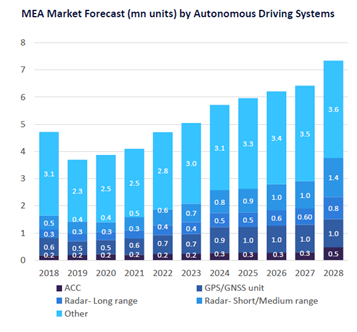

Asia-Pacific currently leads the global autonomous driving systems market, accounting for 93.3 million units in 2023, followed by Europe (64.3 million units) and North America (46.4 million units), according to GlobalData. However, the Middle East and Africa (MEA) is set to be the fastest-growing region for the sector, with a CAGR of 7.8% forecast for the period of 2023-28.

The Middle Eastern territories’ commitment to reducing carbon emissions and diversifying transport options is set to be a key factor in this growth. According to GlobalData, new vehicle registrations among the Gulf Cooperation Council (GCC) formed 46% of the MEA regional total, illustrating the area’s growing importance to the global automotive market.

Ahead of the curve is the UAE. In Dubai, the aforementioned legislation is already doing much to facilitate EV adoption across the city. Hansan Negriz, managing director of the Al-Futtaim Electric Mobility Co., headquartered in Dubai, notes that “the UAE EV market is expected to grow at a rate of 30% annually until 2028, which represents a significant growth and market potential.” The Dubai Electricity and Water Authority (DEWA) aims to enable this by growing the city’s network of public charging stations by 170% over the next three years.

On the autonomous vehicle front, Dubai has instituted a world-leading Autonomous Transportation Strategy. With the aim of transforming 25% of the total transportation in Dubai to autonomous by 2030, Dubai is trialling autonomous taxis in the Jumeirah district under the authority of the Dubai Roads and Transport Authority (RTA).

Drone uptake is also increasing in Dubai, where a healthy regulatory environment has allowed for multiple real-word tests involving pilot passenger drones as well as drone deliveries. Dubai’s Civil Aviation Authority (CAA) has been key in setting out an innovative testing framework. A world-first partnership between the RTA, Skysports, and Californian drone startup Joby Aviation will see passenger taxis take flight over Dubai in 2026. Such drone flights could slash travel times across the city, with a journey from Dubai International Airport to Jumeriah potentially taking 10 minutes by drone rather than 45 minutes by car.

Building the mobility industry of the future in Dubai

While EVs are hitting the roads in their thousands, AVs and drones remain in an experimental stage. However, all three areas of mobility require more dedicated innovation and testing to improve as far as technology allows. The lithium-ion batteries that currently power EVs are expensive and susceptible to supply chain disruption, while AVs and drones need to be piloted more extensively and across a variety of environments to test the limits of the tech and build public trust.

Here to help startups, small-to-medium enterprises (SMEs), and multinational corporations (MNCs) innovating in the mobility area is Dubai Silicon Oasis (DSO). As a member of the Dubai Integrated Economic Zones (DIEZ), DSO is a gateway for companies seeking to benefit from the UAE’s supportive regulatory environment and groundbreaking funding programmes.

DSO’s unique testing spaces provide the ideal arena for trialling transport. The Dubai Experimental Zone has already been used to trial a variety of projects, including a series of autonomous buses in 2023’s Dubai World Challenge for Self-Driving Transport. Moreover, July 2023 also saw the pilot of drone delivery, with medicines successfully delivered from DSO’s Fakeeh University Hospital to the Cedre Villas residential estate several kilometres away. In partnership with Talabat UAE, DSO also hosted a trial of their ‘talabots’, robots capable of delivering food within a 3 kilometre range.

Of the trial, DSO’s Director-General Dr. Juma Al Matrooshi said, “Smart mobility is one of the six pillars of DSO’s Smart City Strategy, which is at the core of piloting carbon-neutral delivery robots in a closely monitored and controlled environment within our hi-tech park.”

With purpose-built offices, co-working spaces, and accommodation, DSO provides a place for entrepreneurs to live, work, and collaborate. The campus’s dedicated Future Mobility cluster provides a collaborative nexus for companies within the sector, providing businesses with networking events and workshops to foster further innovation. Events such as the MENA EV Show, hosted annually at DSO, give a platform to leading speakers and exhibits from across the region to harness the development of sustainable vehicles. Access to funds such as DIEZ’s dedicated Venture Capital fund, Oraseya Capital, further provides future mobility businesses and other tech industries based in DSO with the tools they need to scale.

Support for innovative mobility solutions has also been bolstered through DSO’s partnership with Schneider Electric. Schneider and DSO have come together to build a new EV charging station at Schneider’s Gulf headquarters, a facility that is expected to provide more than 300,000 km of driving distance every year to all EV owners and thus save an estimated 40,000 kg of carbon dioxide in car-direct-emissions.

“We are delighted to welcome Schneider Electric to our range of partners in this effort, to collectively contribute to the realisation of the UAE’s goal for Net Zero by 2050,” says Nawaf Al Khater, Senior Director of Planning and Design at DIEZ. “As a testbed for innovation and technology, we are keen on playing an active role in the ongoing transition to electric mobility by enabling conducive infrastructure.”

To learn more about scaling your business and investing in DSO, download the free whitepaper below.