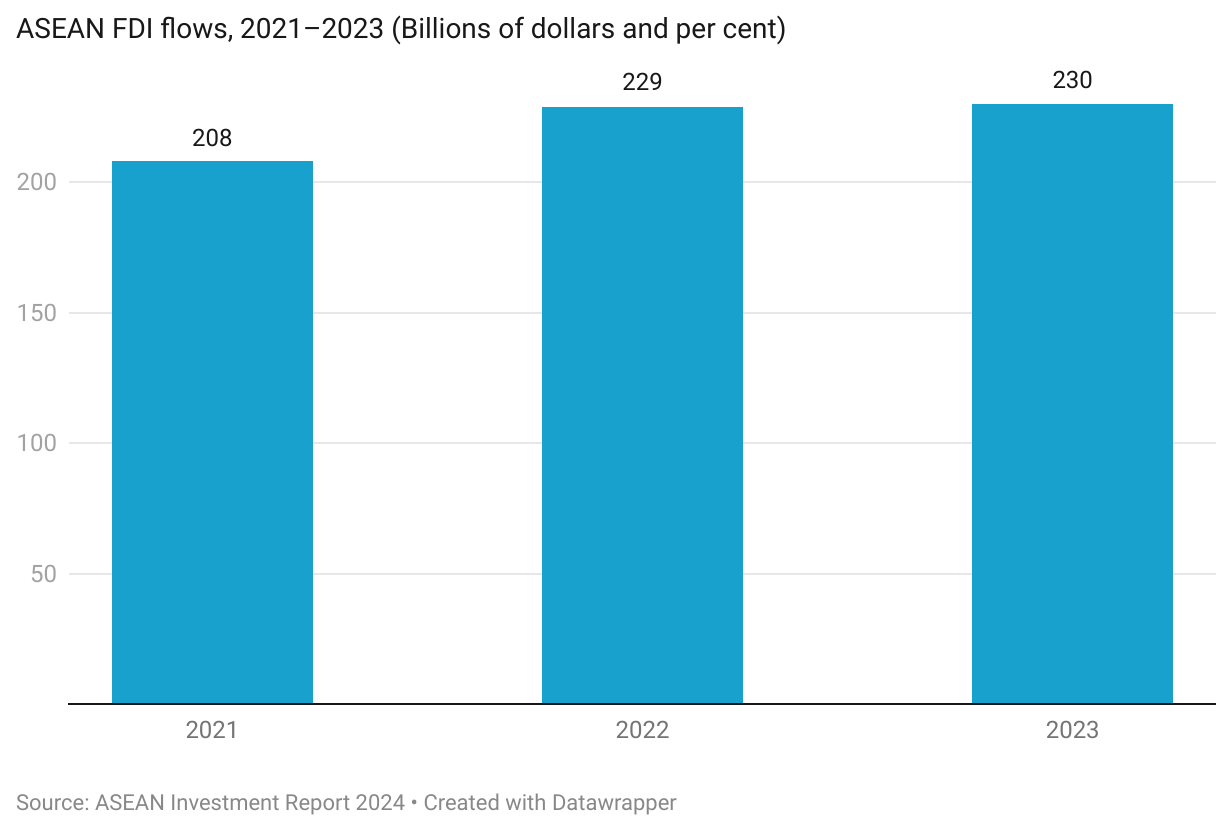

In 2023, foreign direct investment (FDI) inflows to the Association of South East Asian Nations (ASEAN) hit a record $230bn, despite a decrease in global investment flows, according to a new joint report from UNCTAD and ASEAN. The trend underscores ASEAN’s attractiveness as an FDI destination across sectors such as financial and digital services and manufacturing. The region has also attracted investments in renewable energy, electric vehicles (EVs) and the digital economy.

ASEAN has a population of more than 650 million and a combined $3.8trn market valuation. Its members include Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam.

Surge in foreign investments

Over the past ten years, FDI inflows into ASEAN have significantly increased.

Since 2016, annual inflows have averaged $170bn, almost doubling the $92bn recorded between 2006 and 2015. This number has risen significantly over the past few years. Between 2021 and 2023, ASEAN averaged $220bn of foreign investment per year.

The region’s share of global FDI has grown since the early 2000s. Between 2006 and 2015, the region made up 6% of the global share of FDI, a figure that grew to 17% in 2023. The region’s FDI stock has increased from $1.7trn in 2015 to $3.9trn in 2023.

Success-driven policies

According to the report, the strong performance can be attributed to increased regional integration, a better investment climate, expanding opportunities and improved sentiment among business associations and investors.

The ASEAN Economic Community Blueprint 2025 also plays a vital role in improving the investment policy environment across the region.

This includes implementing regional agreements and frameworks aimed at enhancing economic integration and stimulating growth in strategic sectors.

Besides, numerous national investment policy measures and multilateral partnerships were adopted to promote and facilitate FDI.

New trends in investing

The research identifies new patterns including robust investment growth from major economies like China, the US and the EU, and rising financial flows into manufacturing and renewable energy.

Furthermore, expanding production networks and supply chain operations among businesses contributes to the industrial ecosystem’s strengthening, which in turn increases FDI.

Suggestions for enabling larger investments

According to the report, ASEAN’s investment prospects after 2025 are positive.

The region is well-positioned to draw substantial investment going forward due to its consistent GDP growth, favourable investment climate and ongoing regional integration.

That said, there is still a need to strengthen ASEAN’s framework for investment facilitation.

The region could also increase FDI by dealing in intraregional investments and enabling small businesses to expand operations across borders.

Additionally, ASEAN can attract greater investment in emerging industries and sectors linked to sustainable development. Some examples are infrastructure, the digital economy, EV supply chain, renewable energy value chain and the development of supply chain networks.

In order to sustain the FDI momentum, the research suggests strengthening industrial ecosystems through public-private partnerships, investing in skills development and fostering greater regional cooperation.

Furthermore, it emphasises that ASEAN should keep utilising the mutually beneficial relationship that exists between FDI, industrial development and regional coordination.