Overview

The latest edition of the Global Financial Centres Index (GFCI 37) reaffirms Mauritius’ status as a leading International Financial Centre (IFC) in the region. The GFCI 37, which evaluates the competitiveness of financial centres worldwide, includes 119 centres in its main index. The rankings were derived from 140 instrumental factors combined with 31,314 financial centre assessments provided by 4,946 respondents to the GFCI online questionnaire.

Performance of Mauritius in the GFCI 37

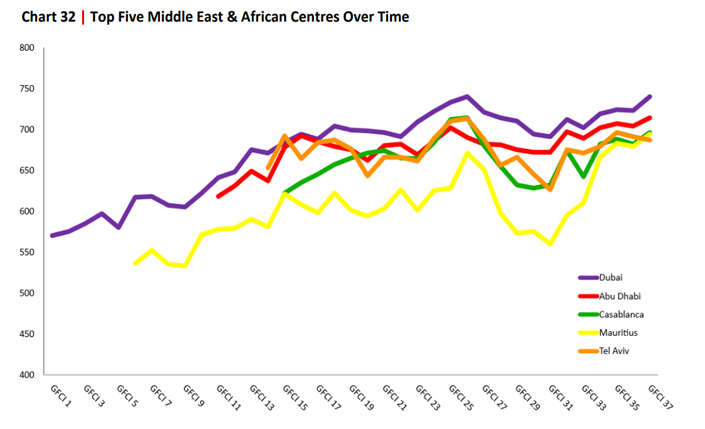

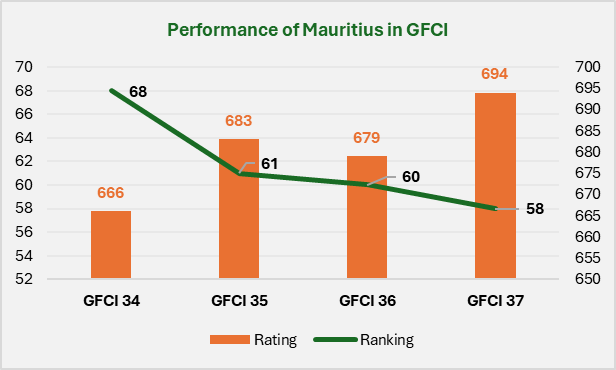

Mauritius has achieved a commendable improvement in GFCI 37, now ranking 58th globally with a rating of 694, marking a significant advancement from its 60th position and rating of 679 in GFCI 36. Regionally, Mauritius has strengthened its standing, now ranking 4th in the Middle East & Africa, trailing behind Dubai, Abu Dhabi, and Casablanca. This marks an improvement from its previous 5th position in the region in GFCI 36. Notably, Mauritius is now the second-best performing IFC in Africa.

GFCI 37 also identifies financial centres that are expected to grow in prominence over the next two to three years. Mauritius features 6th among the top 15 centres globally likely to become more significant, receiving 24 mentions over the past 24 months. This recognition underscores Mauritius’ increasing appeal as a financial hub.

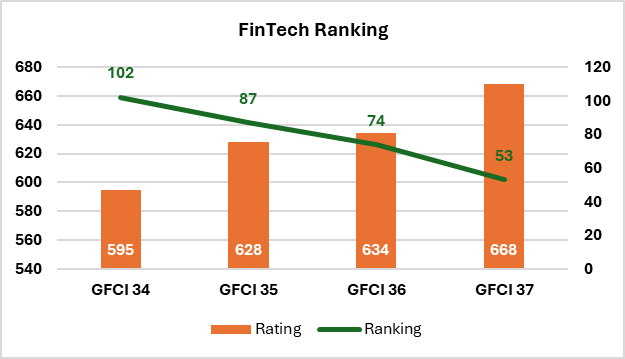

Alongside its main rankings, GFCI 37 evaluates financial centres based on their FinTech capabilities. Mauritius has shown remarkable progress in this domain, ranking 53rd with a FinTech score of 668—an impressive leap of 21 places and 34 points from GFCI 36. This reflects the country’s strides in driving a robust FinTech ecosystem within its IFC. Survey respondents highlighted key factors contributing to this advancement, including Access to Finance, an Ecosystem That Encourages Innovation, ICT Infrastructure, Demand, and Availability of Skilled Staff.

This progress reaffirms Mauritius’ commitment to positioning FinTech as a key driver of economic development. The jurisdiction has proactively strengthened its regulatory framework, enhanced business facilitation, and invested in resilient financial and technological infrastructure. Over the years, the Mauritius IFC has diversified its offerings and introduced innovative financial products such as the Variable Capital Company (VCC) licence and the Virtual Asset and Initial Token Offerings (VAITOS) licence, adapting to evolving global trends and attracting FinTech-savvy investors.

Mauritius’ consistent progress in the GFCI rankings reflects its commitment to maintaining a robust and competitive financial ecosystem, further solidifying its position as a strategic gateway for investment and financial services in the region.

Please participate in the surveys for the Global Financial Centre Index (GFCI), the Global Green Finance Index (GGFI), and the Smart Centres Index (SCI) to provide your rating for the Mauritius jurisdiction by clicking on the links below: